Spotlight: Tabs3 General Ledger

July 2024 Tags: Chart of Accounts, General Ledger, Reconciliation, Reports

No comments

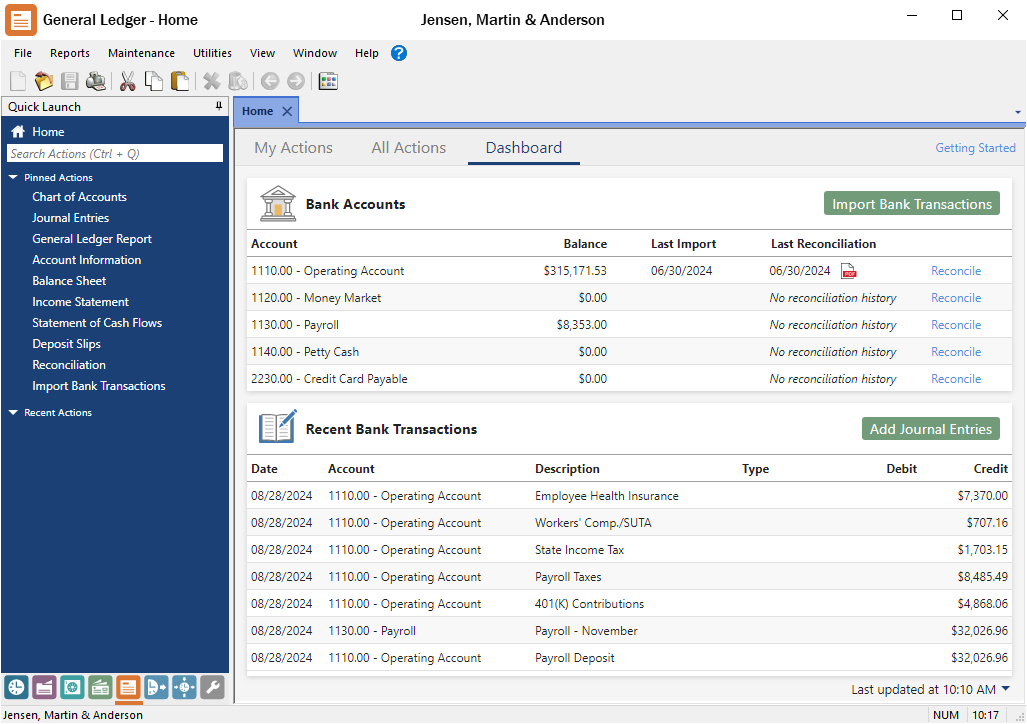

Tabs3 General Ledger (GL) is a general ledger accounting application that is based on a double-entry accounting system. Chart of accounts and financial statement formats can be defined, allowing you to use your current chart of accounts. The availability of multiple departments allows you to create reports based on certain departments or the firm as a whole. Journal entries track debits and credits. Optionally create budgets for each expense account, and compare budget and actual amounts from year to year.

GL offers bank and credit card reconciliation, printable deposit slips, summarized or detailed reports to help track your financial data, and more. If you have journal entries that must be made monthly, you can set up recurring entries to easily post a batch of entries once a month in a single process.

GL can be used as a stand-alone ledger application for any business, or it can be combined with other Tabs3 Software applications for full integration. Journal entries can be submitted to GL through Tabs3 Billing, Accounts Payable, Trust Accounting, and also Peninsula Software’s PenSoft® Payroll software. Additionally, a standard input format is included, providing the ability to import journal entries from other software.

For more information regarding Tabs3 General Ledger, contact your local consultant or our Sales Department at (402) 419-2200.

General Ledger Q&A: Alternate Account Order

September 2022 Tags: Chart of Accounts, General Ledger, Reports

No comments

I need to be able to subtotal my GL accounts in a different order to report on income for the firm. However, the current order is what the firm usually needs. I would only need this alternate order for reporting purposes. What can I do?

GL has the ability to set an additional account order in your Chart of Accounts, specifically for this purpose. This can be particularly useful when you need to subtotal accounts in more than one way.

To print reports using an alternate account order, you must enable the use of an alternate account order, and then specify the order in the Chart of Accounts.

To enable the use of an alternate account order

- From the Quick Launch, search for and select “Edit GLS Client.”

- Select the desired Client Number.

- In the Options section, select the Allow an alternate account order to be defined in the Chart of Accounts check box.

- Press Ctrl+S.

To set up an alternate account order

- From the Quick Launch, search for and select “Chart of Accounts.”

- Right-click and select View Alternate Account Order.

- Drag and drop accounts to their desired position.

Once defined, reports can be run using the alternate account order by selecting the Use Alternate Account Order check box on the Account tab of many GL reports.

General Ledger Q&A: Renumber General Ledger Account

March 2022 Tags: Chart of Accounts, General Ledger

No comments

While I was running a report, I noticed that an account was given the wrong account number. Is there a way to change the account number without losing any journal entries?

This can be accomplished by running the Renumber GLS Account utility. All associated journal entries, deposit slips, and recurring entries are also renumbered.

To renumber an account

- In the Quick Launch, search for and select “Renumber Account.”

- In the Old Account Number field, select the account you want to renumber.

- In the New Account Number field, enter the new account number you want for the account.

- Click OK.

Note: Renumbering an account in GL will automatically update the references to that account in Tabs3 Billing, AP, and Trust integration settings. However, GL report definitions and GL Report Writer reports that use the Old Account Number will not be updated to use the New Account number.

Spotlight: Statement of Cash Flows Report

November 2019 Tags: Chart of Accounts, General Ledger, Reports, Version 19

No comments

The Statement of Cash Flows Report (Reports | Statement of Cash Flows) in GLS shows how the firm’s cash position has changed over a period of time. It shows the amount of cash earned from profit, where you received additional cash, and where your cash was spent. The report shows how much cash was provided or used by the following types of activities:

- Operating Activities – Shows how much cash was provided by profit-making activities, such as the sale of goods and services.

- Investing Activities – Shows how much cash was invested in assets such as equipment and furniture.

- Financing Activities – Shows how much cash was provided by long-term liabilities and equity. These financing activities often include loans and investments by the owner. They also include any reductions in equity due to owner draws.

Accounts can be classified into the three sections via Account Setup. All Detail Balance Sheet Accounts, except for ones marked as a Bank Account and the Retained Earnings account, can be configured to display in one of the three designated sections. Bank Accounts are excluded because the purpose of this report is to calculate the cash amounts based on the other information. The Retained Earnings account is also excluded because the Net Income (the net change in Retained Earnings) displays at the beginning of the report as a starting point.

To classify accounts as operating, investing, or financing

- From the File menu, point to Open and select Chart of Accounts.

- Double-click the desired account.

- From the Report Options tab, in the Statement of Cash Flows Classification section, select the desired classification.

- Click Save.

- Repeat steps 2-4 for each account as needed.

Quick Tip: Alternate Account Order

March 2018 Tags: Chart of Accounts, General Ledger, Reports

No comments

Did you know that you can set up your General Ledger Software (GLS) accounts in an alternate order for reporting purposes? This can be particularly useful when you need to subtotal accounts in more than one way.

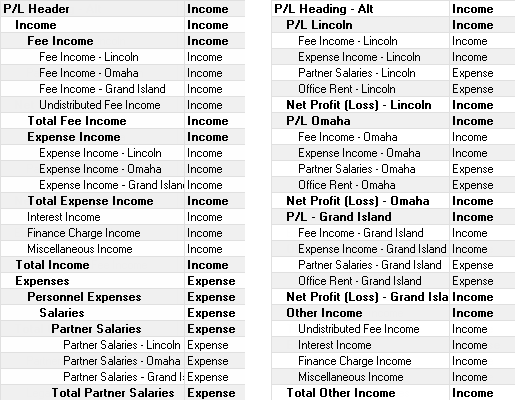

In the example below, you can see how the alternate account order can be used for profit centers. The chart of accounts on the left represents accounts broken down by type (i.e., fee income, expense income, etc.), whereas the chart of accounts on the right represents accounts broken down by profit centers (i.e., Lincoln, Omaha, Grand Island, etc.).

To print reports using an alternate account order, you must enable the use of an alternate account order, and then specify the order in the Chart of Accounts.

To enable the use of an alternate account order

- From the Utilities menu, select Edit GLS Client.

- Select the desired Client Number.

- In the Options section, select the Allow an alternate account order to be defined in the Chart of Accounts check box.

- Press Ctrl+S.

To set up an alternate account order, right-click in the Chart of Accounts (File | Open | Chart of Accounts) and select View Alternate Account Order. You can now drag and drop accounts to their desired position. Once defined, reports can be run using the alternate account order by selecting the Use Alternate Account Order check box on the Account tab of any report that has an Account tab.

Spotlight: Adding or Changing Accounts in GLS

November 2017 Tags: Chart of Accounts, General Ledger

No comments

When working in General Ledger Software (GLS), your accounts do not typically change much once they have been established. Because of this, it’s easy to forget the ins and outs of making changes to the chart of accounts.

Here are some quick instructions to add a new account or make adjustments to existing accounts when the time comes.

To add a new account

- From the File menu, point to Open and select Chart of Accounts.

- Select the account directly above where you want the new account to appear in the Chart of Accounts.

- Press Ctrl+N.

- The New Account window will be displayed. Select the desired option and click OK.

- The Account Setup window will be displayed. Enter the remaining information for the account and click Save.

- If you are adding a heading or total account, the Create Paired Account window will be displayed, allowing you to select the account number for the paired account.

- Select the desired option for the paired account’s account number and click OK.

- The Account Setup window is displayed. Enter the remaining information for the account and click Save.

- If you are adding a heading or total account, the Create Paired Account window will be displayed, allowing you to select the account number for the paired account.

Changing and moving accounts

When you want to make changes to an account, there are different types of changes you can make:

- Edit the settings for the existing account by double-clicking the account and then making the desired changes.

- Drag and drop the account to a different location in the chart of accounts to adjust the location of the accounts on reports:

- Select the account you want to move.

- Grab the

icon by clicking on it; the pointer will become a

icon by clicking on it; the pointer will become a  .

. - Drag the selected account to the desired position and release the mouse button.

- Change the Account # by using the Renumber Account utility (Maintenance | Renumber | Account).

Now, when you need to make changes to your Chart of Accounts, you’ll be ready!

Recent Comments

- Tabs3 Software on Feature Article: Year-End is Fast Approaching!

- Linda Thomas on Feature Article: Year-End is Fast Approaching!

- James Hunter on Spotlight: Reorder Fees

- Tabs3 Software on Video of the Month: PracticeMaster Conflict of Interest

- Stephanie Biehl on Video of the Month: PracticeMaster Conflict of Interest