Accounts Payable Q&A: Using Miscellaneous Vendors

March 2023 Tags: Accounts Payable, Vendors

No comments

We need to write a check to a company, but we do not plan on writing more checks to them in the future. Do we need to create a full vendor with an associated contact for this company?

AP includes a Miscellaneous Vendor option to create a general one-time payment to people or companies that will not require a 1099. When creating invoices for a miscellaneous vendor, you will be prompted to specify a name and address or specify an existing contact for each invoice.

- In the Quick Launch, search for and select “Vendor Information.”

- Press Ctrl+N to create a new vendor.

- Specify the Vendor number you want to use for your miscellaneous vendor and click OK.

- Select the Miscellaneous Vendor check box.

- Specify a name for the vendor (e.g., “Miscellaneous Vendor”) in the Name field.

- Press Ctrl+S.

Keep in mind that checks generated for a miscellaneous vendor cannot be moved to a standard vendor without voiding and re-entering them. If there is a chance you will need to generate a 1099 for the recipient, we recommend creating a standard vendor for them rather than using a miscellaneous vendor.

Accounts Payable: Renumber Vendor

January 2023 Tags: Accounts Payable, Vendors

No comments

We just realized that the last few vendor numbers were entered outside of our numbering scheme. Is there a way to change the vendor numbers, or will we have to delete them and recreate them one at a time?

The Renumber Vendors program can be used to assign new numbers to existing vendors. All invoices, manual checks, EFTs, posted checks and EFTs, voided checks, recurring entries, and vendor productivity amounts are renumbered as well.

To renumber a vendor

- In the Quick Launch, search for and select “Renumber Vendor.”

- In the Old Vendor Number field, select the vendor you want to change

- In the New Vendor Number field, enter the new number for the vendor.

- Click OK.

Your vendor will now have the new number and is ready for use.

Feature Article: Unified Contacts

March 2022 Tags: Accounts Payable, Contacts, Payees, PracticeMaster, Tabs3 Billing, Trust Accounting, Users, Vendors, Version 2022

No comments

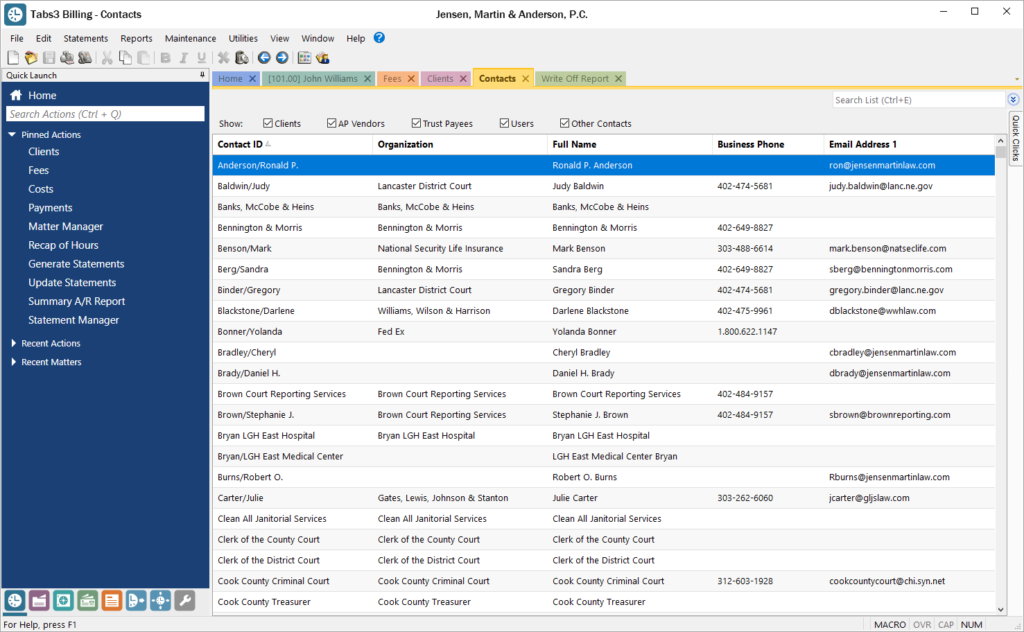

In Version 2022, all contact information has been consolidated for all Tabs3 Software applications.

The Contact file now includes information for Trust payees, AP vendors, and users, making it easy to update address information in one place, including clients, billing contacts, related parties, vendors, payees, and logon users.

The Contact Information window is available in Tabs3 Billing, PracticeMaster, Trust Accounting, Accounts Payable, and System Configuration. This window now includes a Details button next to the Full Name field for individual contacts, which provides access to separate First Name, Middle Name, Last Name, and Initials fields. To select a contact, the Contact Lookup window has been enhanced for each of these applications, including a SnapShot pane, as well as check boxes at the top making it easy to quickly filter the list to just clients, AP vendors, Trust Payees, etc.

You can update to Version 2022 by going to Tabs3.com/update.

Video of the Month: Working with 1099s

January 2022 Tags: 1099s, Accounts Payable, Resources, Trust Accounting, Vendors

No comments

Tax season is here again and Tabs3 Software is ready to help you quickly file your Forms 1099-MISC and 1099-NEC.

The Working with 1099s video covers how to verify which vendors and payees need to report 1099 information, how to generate 1099s, and provides solutions for filing your 1099s. Since Tabs3 Software has partnered with Nelco to provide Tabs3 E-file, you can easily E-file your Forms 1099-MISC, 1099-NEC, and 1096.

Watch this four-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos in the Quick Launch by searching for and selecting “Training Videos.”

Video of the Month: Adding a Vendor

May 2020 Tags: Accounts Payable, Resources, Vendors

No comments

If you are new to Accounts Payable, or haven’t added a vendor in a while, it can be helpful to have a refresher on what options and fields are available.

The Adding a Vendor video walks you through adding a vendor that you will pay on a regular basis, shows you how to work with Miscellaneous vendors, and includes helpful tips for choosing the right 1099 options.

Watch this three-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos while in the software by selecting Help | Training Videos.

Recent Comments

- Tabs3 Software on Feature Article: Year-End is Fast Approaching!

- Linda Thomas on Feature Article: Year-End is Fast Approaching!

- James Hunter on Spotlight: Reorder Fees

- Tabs3 Software on Video of the Month: PracticeMaster Conflict of Interest

- Stephanie Biehl on Video of the Month: PracticeMaster Conflict of Interest