Quick Tip: Reverse Write Off

July 2025 Tags: Clients, Tabs3 Billing, Write Offs

No comments

Did you know that you can reverse write offs? The Reverse Write Off feature allows you to reverse a write off that was created via Write Off Client. The information for the write off will be backed out, returning the client ledger, accounts receivable, receipt allocation, and productivity to their original values.

To reverse a write off

- In the Quick Launch, search for and select “Reverse Write Off.”

- Select the Client ID.

- In the Reference Number field, select the write off you want to reverse.

- Click OK.

Billing Q&A: Detailed Write Off Information

April 2023 Tags: Tabs3 Billing, Write Offs

No comments

We wrote off an amount for a client that contained fees, costs, and tax amounts. How can we see how the write off applied?

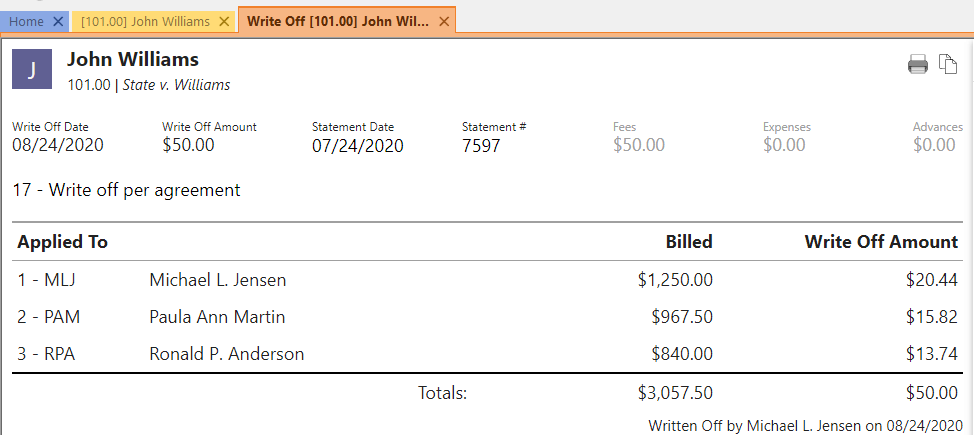

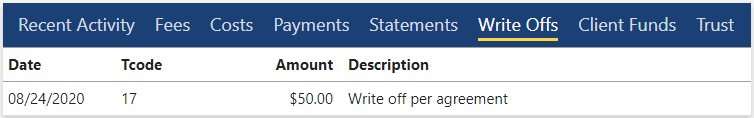

You can view detailed information on a write off via the Tabs3 Billing Matter Manager. This allows you to see the original billed amount as well as the fees, expenses, and/or advances written off. Each timekeeper, cost type, tax amount, and/or finance charge that was written off is also shown, along with statement information.

To view detailed write off information

- In the Quick Launch, search for and select “Matter Manager.”

- Select the client’s matter.

- In the List Content section, click Write Offs.

- Select the write off you want to view.

Video of the Month: Working with Write Offs

March 2022 Tags: Reports, Resources, Statements, Tabs3 Billing, Tabs3 Billing Matter Manager, Write Offs

No comments

Being able to easily enter and track write offs is essential. With Tabs3 Billing, you can quickly enter write offs and apply them to a matter’s accounts receivable with just a few clicks!

In the Working with Write Offs video, see how easy it is to write off all or a portion of a client’s accounts receivable from the Statement Manager. When it comes to tracking Write Offs, use the convenient Write Off tab in the Matter Manager or use the Write Off Report to access detailed information about multiple write offs at the same time.

Watch this three-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos in the Quick Launch by searching for and selecting “Training Videos.”

Feature Article: Write Off Report

October 2021 Tags: Reports, Tabs3 Billing, Version 2021, Write Offs

No comments

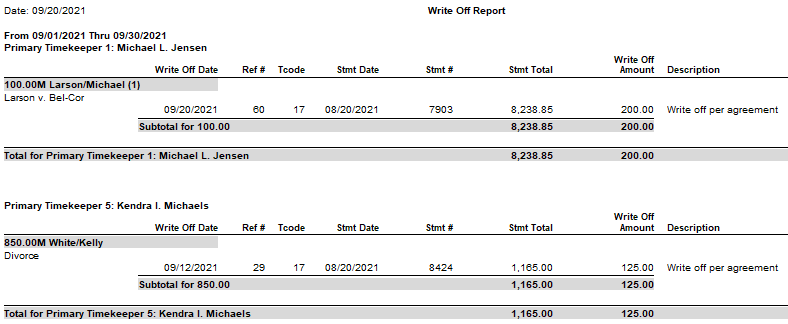

The Write Off Report is here! View all write off information in a single, dedicated report. The Write Off Report can include the following options:

- Date Range

- All timekeepers or select timekeepers

- All transaction codes or select transaction codes

- Detail information for each write off

- Allocation breakdown

- Statement information

- Reversed write offs

Additionally, this report can be sorted by working timekeeper.

To run a Write Off Report

- In the Quick Launch, search for and select “Write Off Report.”

- Optionally select a Client ID

- Select any other settings as desired.

- Click OK.

This report is available in Version 2021 (Build 20.6.2) and later.

Feature Article: New Lists in Tabs3 Billing

September 2021 Tags: Client Funds, Clients, Contacts, Costs, Fees, Payments, Tabs3 Billing, Version 2021, Write Offs

No comments

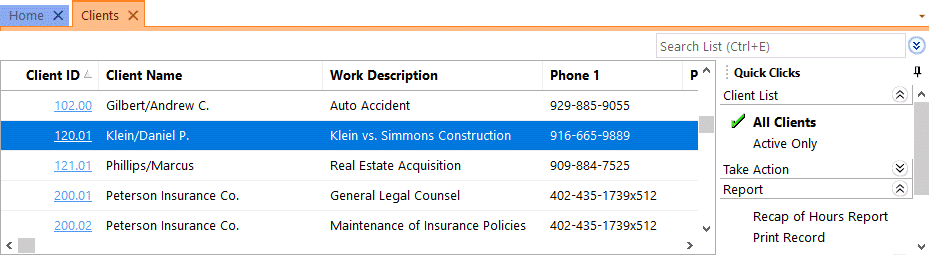

We added a new way to view clients, contacts, fees, costs, payments, client funds, and write offs without having to run a report! When accessing the new Tabs3 Billing lists, you can work with entries using the actions in the Quick Clicks pane, or drill down for additional details. Lists are available via the File | Open menu in Tabs3 Billing or by searching the Quick Launch for “clients,” “contacts,” “client funds,” “fees,” “costs,” “payments,” and “write offs.” The data entry windows for these record types are now available via File | Data Entry or by searching the Quick Launch for “client information,” “contact information,” “client funds entry,” “fee entry,” “cost entry,” and payment entry.”

Filtering

Filtering is a powerful feature. For example, you could filter the Client file to only show clients for which you’re the primary timekeeper. As another example, you could filter the Fee file to only show fees entered in the last week. There are a few ways to filter in the lists.

- The Search Box allows on-the-fly filtering capabilities and can be used to filter data based on keywords included in any column shown in the current column layout.

- The List group in the Quick Clicks pane provides different filtering options for each list. For example, the Contacts List provides the option to filter for All Contacts or Active Only.

- The Filter group in the Quick Clicks pane can be used to set up easy or complex filters that you can reuse. Filters can be added via Manage Filters.

- The QuickViews group in the Quick Clicks pane can be used to create different views of your data. Each QuickView can include a filter, column layout, and sort. QuickViews can be added via Manage QuickViews.

Quick Clicks

The Quick Clicks pane includes the following additional groups:

- The Take Action group of the Quick Clicks pane includes additional actions you can take. For example, in the Fees List, you can transfer transactions, replicate transactions, set the fee’s status to hold, set the fee’s status to print, change WIP transactions, write-up or write-down fees, generate statements, and add a new fee.

- The Report group of the Quick Clicks pane includes any reports that are relevant to the current list. For example, the Write Offs List includes the Write Off Report and the Client Ledger Report.

- The Column Layout group of the Quick Clicks pane automatically includes the Standard and (default) column layouts. Column layouts can be added via Manage Column Layouts.

- The Customize Current View group of the Quick Clicks pane includes Manage Quick Clicks, Refresh, and List Preferences. Manage Quick Clicks provides the ability to add, edit, or delete filters, QuickViews, and column layouts, as well as to organize the Quick Clicks. List Preferences include row height, row colors, and grid lines for the list.

Download the latest version of the software to get this great new feature!

Feature Article: View Write Offs

February 2021 Tags: Tabs3 Billing, Version 2021, Write Offs

No comments

Did you know that you can easily see a list of write offs for any client, as well as how each write off is applied?

Beginning with Version 2021, you can access write off information via the Tabs3 Billing Matter Manager. When selecting a write off, you can see the date and amount of the write off, statement information, how it was applied, and more.

To access write off information via Tabs3 Billing Matter Manager

- Open Matter Manager from the Quick Launch.

- Select the desired Client.

- Click the Write Offs list.

- Click the write off for which you want more information.

Feature Article: Version 2021 is Released!

January 2021 Tags: 1099s, Accounts Payable, Email Statements, Payments, Reports, Statements, Tabs3 Billing, Tabs3 Billing Matter Manager, Trust Accounting, Version 2021, Write Offs

No comments

Version 2021 has some great new features we know you’ll want right away!

All Applications

- Simplified Update – Updating from Version 2020 to Version 2021 does not require a conversion. If updating from Version 19 to Version 2021, only a single conversion is required.

- New Look – We’ve updated the icons for all of the actions on the Home page in each Tabs3 Software application to provide a fresh look.

Tabs3 Billing Highlights

- Payment Information – Provides detailed payment allocation information for both archived and work-in-process payments. In addition to payment allocation, this page shows associated Tabs3 General Ledger transactions and payment adjustments (refunds or reversals).

- Write Off Information – Provides detailed information about the selected write off, including a breakdown of how the write off was applied (each timekeeper, cost type, tax amount, or finance charge) across each statement that was written off, and who performed the write off.

- Matter Manager:

- Write Off List – This list provides an easy way to see any write off performed on the matter. Clicking an entry in the list displays the Write Off Information page.

- Statement Status Indicators – The statement list in the Matter Manager now includes color-coded indicators to help you see at a glance which statements are unpaid and for how long.

- Email an Individual Statement – In the Statement Manager or Statement Information window, a new Send Email action is available. This reprints the selected statement, just like using the Reprint Updated Statements feature, and then starts a new email with the statement attached.

- Report Drilldown – We’ve updated numerous Tabs3 Billing reports to support drilling down to statements, payments, and write offs in the Report Preview window.

Tabs3 Trust Accounting and Accounts Payable Highlights

- IRS 1099-MISC and 1099-NEC Changes for Tax Year 2020 – We’ve updated the software to support new requirements from the IRS for tax year 2020.

Updating to Version 2021 is as easy as using Check for Updates (Help | Check for Updates)!

Spotlight: Writing Off a Client

August 2018 Tags: Tabs3 Billing, Write Offs

No comments

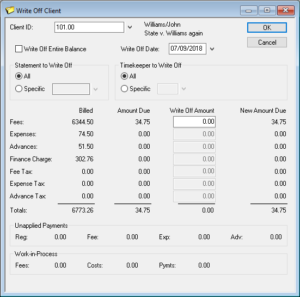

Did you know that you can write off all or a portion of a client’s accounts receivable balance? When a write off is performed using the Write Off Client program, a special write off record is created and stored in the client ledger file for audit trail purposes and adjustments are made to receipt allocation records. Write offs can also be shown on the next statement (provided a description-only transaction is entered when the write off is  performed).

performed).

The Write Off Client program is used to write off all or a portion of a client’s accounts receivable balance. If you select to write off an individual statement, you have the option of writing off the entire statement or selecting which portion of the statement you want to write off. You also have the option of writing off the balance for all timekeepers or a specific timekeeper for all statements or an individual statement.

To perform a write off

- From the Maintenance menu, point to Client Related and select Write Off Client.

- Enter the Client ID.

- Select the desired options.

- Click OK.

- Click Yes to continue. You will be prompted to enter a description-only transaction to indicate why the write off occurred.

- If you want a transaction to be saved to the Fee file, enter a Description and click OK.

- If you do not want a transaction saved to the Fee file, click Cancel.

Additionally, you have the option of reversing a write off if you find the write off was in error, or you want to change the way the write off was performed.

To reverse a write off

- From the Maintenance menu, point to Client Related and select Reverse Write Off.

- Select the Client ID.

- Select the Reference Number of the write off you want to reverse.

- Click OK.

Video of the Month: Write Off Clients

January 2017 Tags: Clients, Resources, Statements, Timekeepers, Write Offs

No comments

From time to time, you may need to reduce a client’s outstanding balance, but how can this be accomplished? The Tabs3 Billing Write Off Clients training video walks you through the process of writing off all or part of a client’s balance.

View this three-minute video here:

Training Videos can be accessed 24 hours a day, 7 days a week, at Tabs3.com/videos. You can also access Training Videos while in the software by selecting Help | Documentation and then clicking the See also link for Tabs3 and PracticeMaster Training Videos.

Recent Comments

- Tabs3 Software on Feature Article: Year-End is Fast Approaching!

- Linda Thomas on Feature Article: Year-End is Fast Approaching!

- James Hunter on Spotlight: Reorder Fees

- Tabs3 Software on Video of the Month: PracticeMaster Conflict of Interest

- Stephanie Biehl on Video of the Month: PracticeMaster Conflict of Interest