Spotlight: Writing Off a Client

August 2018 Tags: Tabs3 Billing, Write Offs

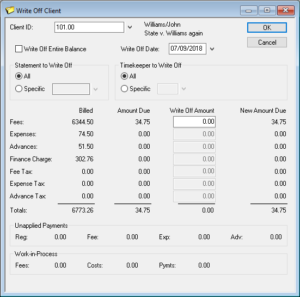

Did you know that you can write off all or a portion of a client’s accounts receivable balance? When a write off is performed using the Write Off Client program, a special write off record is created and stored in the client ledger file for audit trail purposes and adjustments are made to receipt allocation records. Write offs can also be shown on the next statement (provided a description-only transaction is entered when the write off is  performed).

performed).

The Write Off Client program is used to write off all or a portion of a client’s accounts receivable balance. If you select to write off an individual statement, you have the option of writing off the entire statement or selecting which portion of the statement you want to write off. You also have the option of writing off the balance for all timekeepers or a specific timekeeper for all statements or an individual statement.

To perform a write off

- From the Maintenance menu, point to Client Related and select Write Off Client.

- Enter the Client ID.

- Select the desired options.

- Click OK.

- Click Yes to continue. You will be prompted to enter a description-only transaction to indicate why the write off occurred.

- If you want a transaction to be saved to the Fee file, enter a Description and click OK.

- If you do not want a transaction saved to the Fee file, click Cancel.

Additionally, you have the option of reversing a write off if you find the write off was in error, or you want to change the way the write off was performed.

To reverse a write off

- From the Maintenance menu, point to Client Related and select Reverse Write Off.

- Select the Client ID.

- Select the Reference Number of the write off you want to reverse.

- Click OK.

Related posts:

Comments are closed.

Recent Comments

- Tabs3 Software on Feature Article: Tabs3 Cloud

- Betty Pinto on Feature Article: Tabs3 Cloud

- Josephine Banaszek on Quick Tip: Application Toolbar

- Christina Weaver on Quick Tip: Use F5 to Insert Time, Date, and User ID

- James Hunter on Spotlight: Reorder Fees