Video: Scheduling Payments with Tabs3Pay

April 2025 Tags: Credit Cards, Payments, Tabs3 Billing, Tabs3Pay

No comments

Skip the hassle of collections this year by scheduling your matter’s one-time and recurring payments with Tabs3Pay!

The Scheduling Payments with Tabs3Pay video walks you through how to schedule a future-dated payment or series of payments, right from the Tabs3 Billing Matter Manager. This feature makes it easy to provide payment plans for your clients and allows you to get paid on a specific date, even when you’re not in the office.

Watch this three-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos in the Quick Launch by searching for and selecting “Training Videos.”

Quick Tip: Tabs3 Billing Entry List Options

February 2024 Tags: Client Funds, Costs, Fees, Payments, Tabs3 Billing

No comments

Did you know that you can do more with Entry Lists than see current work-in-process transactions? The Fee, Cost, Payment, and Client Funds Entry Lists can be printed, filtered, and set to include archived records.

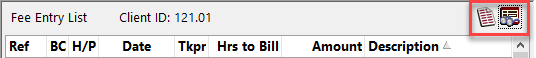

Entry Lists can be toggled to be hidden or displayed using the ![]() (Toggle List) button or Alt+G. Once the Entry List is displayed, the following additional buttons are available:

(Toggle List) button or Alt+G. Once the Entry List is displayed, the following additional buttons are available:

- Print List – Click the

(Print List) button to print a list of all transactions currently displayed in the Entry List.

(Print List) button to print a list of all transactions currently displayed in the Entry List. - Select Date – Click the

(Select Date) button, or press Alt+L, to select a date for which transactions will be displayed. This button is only available when filtering by Transaction Date or Entry Date via View Options.

(Select Date) button, or press Alt+L, to select a date for which transactions will be displayed. This button is only available when filtering by Transaction Date or Entry Date via View Options. - View Options – Click the

(View Options) button, or press Alt+O, to filter the Entry List by Client ID, Transaction Date, or Entry Date; select to include only those records for a certain Timekeeper or User ID, or select to Include Archived Records; or select a List Location of Right or Bottom.

(View Options) button, or press Alt+O, to filter the Entry List by Client ID, Transaction Date, or Entry Date; select to include only those records for a certain Timekeeper or User ID, or select to Include Archived Records; or select a List Location of Right or Bottom.

You enter data regularly; make sure you are getting the most out of your Entry List by showing the information you want to see and quickly printing lists when needed.

Feature Article: Apply Payments to Multiple Matters

January 2024 Tags: Clients, Payments, Statements, Tabs3 Billing

No comments

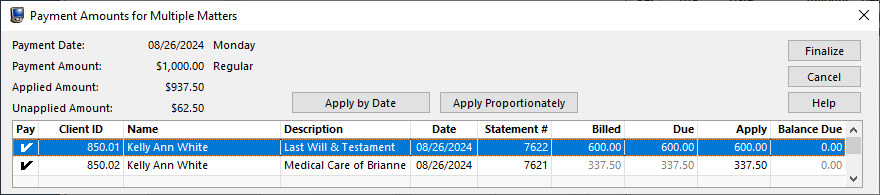

Did you know that you can apply payments to multiple matters for the same client? Payments can be allocated by statement date, proportionally, or manually.

Note: The split payments will make individual journal entries in Tabs3 General Ledger that will be linked together and shown as one item on the Reconciliation and Deposit Slip Report.

To apply a payment to multiple matters

- In the Quick Launch, search for and select “Payment Entry.”

- Select the desired Client ID.

- Enter the payment as you would normally. The information entered in each field will be automatically replicated for each matter’s payment.

- Click the

(Apply Payment to Multiple Matters) button or press Alt+A.

(Apply Payment to Multiple Matters) button or press Alt+A. - In the Payment Amount for Multiple Matters window:

- Click the Apply by Date button.

–or–

Click the Apply Proportionately button.

–or–

In the Apply column, enter the amount you want to apply to each matter. - Click Finalize.

- Click the Apply by Date button.

The Apply Payments to Multiple Matters option is also available when entering or importing Tabs3Pay payments. (Note: To use the Apply Payments to Multiple Matters option when importing Tabs3Pay payments, you must select the View each Payment record before creating option in the Import Online Payments window.)

Feature Article: Payment Adjustments

March 2023 Tags: Payments, Refunds, Tabs3 Billing

No comments

How do you handle overpayments, checks that don’t clear the bank, or checks entered for the wrong account? Make a payment adjustment! Payment adjustments can be used to refund or reverse payments.

When a client pays more than is due, you may want to refund part of the payment. In order to refund a payment, the payment must have been final billed and updated. Additionally, only the unapplied portion of a payment can be refunded.

In some situations, you may need to reverse the entire payment. Typically, this is because either a check didn’t clear the bank or a payment was entered to the wrong account. Like refunds, a payment can only be reversed if it has already been final billed and updated. However, payments can be reversed regardless of whether a portion is currently unapplied or not.

When refunding or reversing payments, the following integration options are available, when applicable:

- When you are set up to process credit cards, and the payment was originally processed via credit card, you will be prompted whether or not to process the adjustment through the processor.

- You will have the option to write a check for the amount (when integrating with AP), create a payment to another client, deposit the amount into client funds, or just record the adjustment.

- When integrating with GL, you will have the option of specifying a date for automatic journal entries.

To reverse or refund a payment

- In the Quick Launch, search for and select “Payment Adjustment.”

- Select the Client ID.

- In the Reference field, select the payment you are adjusting.

- In the Adjustment Information section, select Reversal or Refund.

- Enter the desired Adjustment Date. This date will be used for reports.

- If you selected Refund, enter the desired Adjustment Amount.

- Click OK.

- Click Yes to continue.

- In the Payment Adjustment Options window, select whether you will be writing a check for the adjustment, just recording the adjustment, creating a payment for another client, or depositing the adjustment into Client Funds.

- Click OK.

- If you are integrating with GL, and did not select the option to write a check, an Adjusting Journal Entries window will be displayed. Select the date to use for adjusting GL journal entries.

- Click OK.

- In the Payment Adjustment Description window:

- If you want a transaction to be saved to the Fee file, enter a Description and click OK.

- If you do not want a transaction saved to the Fee file, click Cancel.

Payment adjustments provide an easy way to refund an amount back to your clients, or to reverse payments when a mistake was made.

Billing Q&A: Electronic Payments for Multiple Matters/Statements

October 2022 Tags: Payments, Statements, Tabs3 Billing

No comments

We have some clients with multiple matters that pay with a credit card. Can we apply a single electronic payment to multiple matters or statements for a client?

Both Tabs3Pay and LawPay can be used with the Apply Payments to Multiple Matters feature. This feature allows you to enter a single payment and apply it to specific matters and statements associated with the client. Apply Payment to Multiple Matters can be used when entering new payments as well as when using the Import Online Payments feature.

To apply a payment to multiple matters or statements when entering a payment

- From the Quick Launch, search for and select “Payment Entry.”

- Enter all information for the payment record, including the Tabs3Pay or LawPay payment method.

- Click the

(Apply Payment to Multiple Matters) button or press Alt+A to open the Apply Payment to Multiple Matters window.

(Apply Payment to Multiple Matters) button or press Alt+A to open the Apply Payment to Multiple Matters window. - A list of matters and their statements will be displayed. Specify the amount to apply to each statement. When you are finished, click Finalize. (Note: For more information on using this window, press F1.)

To apply a payment to multiple matters or statement when importing a payment

- From the Quick Launch, search for and select “Import Online Payments.”

- Double-click the payment you want to import to open the Payment Entry window.

- Click the

(Apply Payment to Multiple Matters) button or press Alt+A to open the Apply Payments to Multiple Matters window.

(Apply Payment to Multiple Matters) button or press Alt+A to open the Apply Payments to Multiple Matters window. - A list of matters and their statements will be displayed. Specify the amount to apply to each statement. When you are finished, click Finalize. (Note: For more information on using this window, press F1.)

Note: LexCharge (formerly ProPay) integration does not support the Apply Payments to Multiple Matters feature. If you are interested in using this feature, visit Tabs3Pay.com for information on signing up for Tabs3Pay.

Quick Tip: Copying a Previous Description into Fee, Cost, Payment, or Client Funds

June 2022 Tags: Client Funds, Costs, Fees, Payments, Tabs3 Billing

No comments

When entering information into the software, have you saved an entry only to realize you needed to enter the same description into the next entry as well? If so, there is an easier and quicker way than going back to the last record to copy the information. When you are in Fee, Cost, Payment, or Client Funds, pressing F2 while in the description field will automatically replace the transaction code’s default description with the Description entered for the previous entry saved during the current data entry session.

Feature Article: Version 2022 is Here!

February 2022 Tags: 1099s, Accounts Payable, Client Funds, Contacts, Costs, Fees, Payments, PM Journal, PracticeMaster, Tabs3 Billing, Trust Accounting, Version 2022

No comments

Version 2022 has some great new features to check out!

Unified Contacts

- Consolidated contact information throughout the Tabs3 Software into a single Contact file, including clients, billing contacts, related parties, vendors, payees, and logon users. This makes it easy to update address information in one place.

- The Contacts list in Tabs3 Billing and PracticeMaster as well as in the Contact lookup window in Tabs3 Billing, Trust Accounting, Accounts Payable, and System Configuration include check boxes at the top making it easy to quickly filter the list to just clients, AP vendors, Trust payees, etc.

- The Contact Information window is now available across Tabs3 Billing, PracticeMaster, Trust Accounting, Accounts Payable, and System Configuration. When working with an individual, a Details button next to the Full Name field allows you to access fields for First Name, Middle Name, Last Name, and Initials.

- The Rename Contact utility is now available across Tabs3 Billing, PracticeMaster, Trust Accounting, and Accounts Payable. This utility has been enhanced to update the First Name, Middle Name, Last Name, and Initials fields. Because information is now stored in the Contact file, this utility replaces the Rename Payee utility in Trust.

Enhanced Lists

- Totals can now be displayed on the Fees, Costs, Payments, Client Funds, Write Offs, and Statement Manager lists in Tabs3 Billing and the Fees and Costs lists in PracticeMaster.

- Added a setting to position data entry lists either below or to the right of the data entry fields. Entry lists are available in the Fee, Cost, Payment, and Client Funds entry windows in Tabs3 Billing, the Trust Transaction entry window in Trust, and the Invoice/Manual Check entry window in AP.

New Filters and QuickViews

- New default filters and QuickViews have been added to the Clients, Fees, Costs, Payments, Client Funds, and Statement Manager lists. These allow timekeepers to easily see records for their own matters. These new QuickViews use a new function to determine the timekeeper assigned to the currently logged in user.

- Added a “My Clients Unpaid” QuickView to the Tabs3 Billing Statement Manager.

- Added the ability to easily filter the PracticeMaster Journal file list to include just Note, Email, Phone, Timer, Research, or Billing Notes by simply selecting the corresponding check box at the top of the list. Previously these check boxes were only available on the Journal tab of the Client file.

1099-NEC Forms

- Updated printing of Form 1099-NEC to utilize the 3-forms-per-page format required by the IRS for Tax Year 2021.

Updated Calendar Code File

- Added Phase/Task and Activity code fields to the Calendar Code file so you can specify which default codes need to be used when converting calendar records to fees for task based billing clients.

Exchange Online Integration

- Updated the PracticeMaster Exchange Connector with a new synchronization option for Exchange Online / Microsoft 365.

Updated Installer

- Updated to a Microsoft Installer. This change requires the first installation to be performed at the server, but will reduce the need to directly access the file server when installing future updates.

For in-depth information on all of the new Version 2022 features, including screenshots, refer to Knowledge Base Article R11880, “Version 2022 Introduction to New Features.” A list with links to all Version 2022 information can be found in R11885, “Version 2022 Information and Resources.”

To download Version 2022, visit Tabs3.com/update or contact your local consultant.

Video of the Month: Tracking Advanced Client Costs in Tabs3 Software

November 2021 Tags: Accounts Payable, Costs, General Ledger, GL Journal Entries, Payments, Tabs3 Billing

No comments

When it comes to tracking your advances, Tabs3 Software provides the tools you need to accurately manage your advanced client costs from start to finish.

See how the integration between Tabs3 Billing, Accounts Payable, and General Ledger makes it easy to enter and track your advances. The Tracking Advanced Client Costs in Tabs3 Software video covers how to set up integration, enter an invoice, and track your advances using the Advanced Client Costs Report.

Watch this five-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos while in the software by selecting Help | Training Videos.

Need to reverse a client’s payment or refund an unapplied overpayment? Tabs3 Billing has the tools you need to easily adjust payments and record the adjustment, all from one place!

The Working with Payment Adjustments video demonstrates how you can quickly locate a payment using the Matter Manager, access detailed information about the payment, and perform an adjustment in just a few easy steps. When integrated with Tabs3 Financials, you can specify how you want to handle creating journal entries and printing a check for the refund or reversal, which can save you time and reduce duplicate entry.

Watch this four-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos while in the software by selecting Help | Training Videos.

Feature Article: New Lists in Tabs3 Billing

September 2021 Tags: Client Funds, Clients, Contacts, Costs, Fees, Payments, Tabs3 Billing, Version 2021, Write Offs

No comments

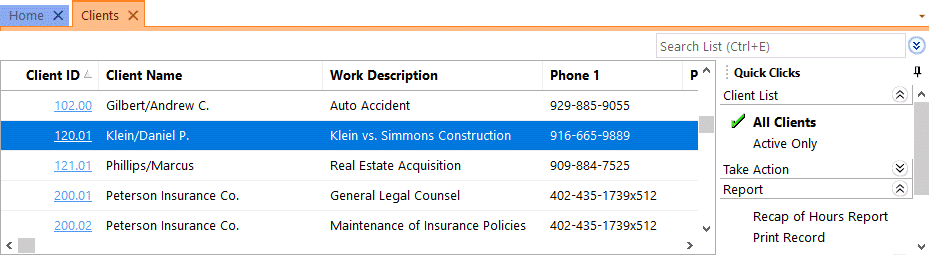

We added a new way to view clients, contacts, fees, costs, payments, client funds, and write offs without having to run a report! When accessing the new Tabs3 Billing lists, you can work with entries using the actions in the Quick Clicks pane, or drill down for additional details. Lists are available via the File | Open menu in Tabs3 Billing or by searching the Quick Launch for “clients,” “contacts,” “client funds,” “fees,” “costs,” “payments,” and “write offs.” The data entry windows for these record types are now available via File | Data Entry or by searching the Quick Launch for “client information,” “contact information,” “client funds entry,” “fee entry,” “cost entry,” and payment entry.”

Filtering

Filtering is a powerful feature. For example, you could filter the Client file to only show clients for which you’re the primary timekeeper. As another example, you could filter the Fee file to only show fees entered in the last week. There are a few ways to filter in the lists.

- The Search Box allows on-the-fly filtering capabilities and can be used to filter data based on keywords included in any column shown in the current column layout.

- The List group in the Quick Clicks pane provides different filtering options for each list. For example, the Contacts List provides the option to filter for All Contacts or Active Only.

- The Filter group in the Quick Clicks pane can be used to set up easy or complex filters that you can reuse. Filters can be added via Manage Filters.

- The QuickViews group in the Quick Clicks pane can be used to create different views of your data. Each QuickView can include a filter, column layout, and sort. QuickViews can be added via Manage QuickViews.

Quick Clicks

The Quick Clicks pane includes the following additional groups:

- The Take Action group of the Quick Clicks pane includes additional actions you can take. For example, in the Fees List, you can transfer transactions, replicate transactions, set the fee’s status to hold, set the fee’s status to print, change WIP transactions, write-up or write-down fees, generate statements, and add a new fee.

- The Report group of the Quick Clicks pane includes any reports that are relevant to the current list. For example, the Write Offs List includes the Write Off Report and the Client Ledger Report.

- The Column Layout group of the Quick Clicks pane automatically includes the Standard and (default) column layouts. Column layouts can be added via Manage Column Layouts.

- The Customize Current View group of the Quick Clicks pane includes Manage Quick Clicks, Refresh, and List Preferences. Manage Quick Clicks provides the ability to add, edit, or delete filters, QuickViews, and column layouts, as well as to organize the Quick Clicks. List Preferences include row height, row colors, and grid lines for the list.

Download the latest version of the software to get this great new feature!

If you need to report on fees, costs, or payments, the Transaction File List or Task Code Billing Report is your answer. Both reports have great flexibility and options. The Transaction File List and Task Code Billing Report have similar options. The Task Code Billing Report includes task based billing clients only. However, the Transaction File List includes both task based transactions and non-task based transactions.

The following are examples of when you may want to run a Transaction File List or Task Based Billing Report:

- The court needs a copy of all work done on a case thus far. Run the report for only the one client, for fees only, and select both Work-In-Process and Archived.

- The case is closed and you want a list of all costs that were billed. Run the report for only the one client, for costs only, and select Archived.

- You want a list of all billed transactions using a particular transaction code or task code for the current quarter. Run the report for the desired transaction code or task code, enter the desired date range, and select Archived.

- You need to find a payment that was entered for the wrong client. Run the report for payments only, select the desired date range, and then use the Search function in the Preview window to look for the payment amount.

- You want a list of everything that was billed last month by a particular timekeeper. Run the report for the one fee timekeeper, enter the desired date range, select Archived, and use a Date Selection of Statement.

For a closer look at the Transaction File List, including detailed examples and report setup, as well as a comparison to the Task Based Billing Report, visit Knowledge Base Article R11039, “How the Tabs3 Transaction File List Can Work for You.”

Feature Article: Version 2021 is Released!

January 2021 Tags: 1099s, Accounts Payable, Email Statements, Payments, Reports, Statements, Tabs3 Billing, Tabs3 Billing Matter Manager, Trust Accounting, Version 2021, Write Offs

No comments

Version 2021 has some great new features we know you’ll want right away!

All Applications

- Simplified Update – Updating from Version 2020 to Version 2021 does not require a conversion. If updating from Version 19 to Version 2021, only a single conversion is required.

- New Look – We’ve updated the icons for all of the actions on the Home page in each Tabs3 Software application to provide a fresh look.

Tabs3 Billing Highlights

- Payment Information – Provides detailed payment allocation information for both archived and work-in-process payments. In addition to payment allocation, this page shows associated Tabs3 General Ledger transactions and payment adjustments (refunds or reversals).

- Write Off Information – Provides detailed information about the selected write off, including a breakdown of how the write off was applied (each timekeeper, cost type, tax amount, or finance charge) across each statement that was written off, and who performed the write off.

- Matter Manager:

- Write Off List – This list provides an easy way to see any write off performed on the matter. Clicking an entry in the list displays the Write Off Information page.

- Statement Status Indicators – The statement list in the Matter Manager now includes color-coded indicators to help you see at a glance which statements are unpaid and for how long.

- Email an Individual Statement – In the Statement Manager or Statement Information window, a new Send Email action is available. This reprints the selected statement, just like using the Reprint Updated Statements feature, and then starts a new email with the statement attached.

- Report Drilldown – We’ve updated numerous Tabs3 Billing reports to support drilling down to statements, payments, and write offs in the Report Preview window.

Tabs3 Trust Accounting and Accounts Payable Highlights

- IRS 1099-MISC and 1099-NEC Changes for Tax Year 2020 – We’ve updated the software to support new requirements from the IRS for tax year 2020.

Updating to Version 2021 is as easy as using Check for Updates (Help | Check for Updates)!

Quick Tip: Viewing Payment Information

January 2021 Tags: Payments, Version 2021

No comments

Did you know that you can now drill down to all payments (including archived payment) in Tabs3 Billing Version 2021? For example, in the Matter Manager, you can click on any payment to view the Payment Date, Payment Amount, which Timekeeper it applied to, the Statement Date and Number to which it applied, and more. This makes it easy to get payment information without having to run a report!

Feature: Accept Credit Card Payments Using LawPay

February 2020 Tags: Client Funds, Credit Cards, Deposit, LawPay, Payments, Tabs3 Billing, Trust Accounting

No comments

Beginning with Version 2020, Tabs3 Billing and Trust Accounting Software (TAS) supports integration with LawPay for electronic processing of payments, client funds deposits, and trust deposits. LawPay supports both credit and debit cards in Tabs3 Billing and TAS, as well as electronic fund transfers (eChecks) from checking or savings accounts in Tabs3 Billing.

Tabs3 Billing allows you to manage the client’s payment methods from either the LawPay tab of the Client file or from the Payment/Client Funds Entry windows. TAS allows you to manage your LawPay payment methods from the Trust Transaction Entry window. You can add or remove payment methods as well as update the email address for each payment method. When an email address is present, the client will automatically be emailed a receipt each time that payment method is used.

Once you have enabled LawPay in Tabs3 Billing, you can include a LawPay payment link in the statements you email to your clients. This allows clients to pay their statement with a credit card or eCheck without anyone at the firm handling sensitive payment information. Once a client has paid their bill via LawPay, you can import the payment into Tabs3 via the Import Online Payments program (Maintenance | Integration | Import Online Payments). See Knowledge Base Article R11767, “Using the Tabs3 Payment Link,” for more information regarding setting up payment links and importing payments. For more information on LawPay integration, see Knowledge Base Articles R11828, “LawPay Integration Frequently Asked Questions,” and R11826, “Configuring LawPay Integration with Tabs3 Software.”

Announcement: Tabs3 Version 2020 Coming Soon!

September 2019 Tags: Accounts Payable, Checks, Client Funds, Credit Cards, General Ledger, LawPay, Payments, Positive Pay, Reports, Tabs3 Billing, Trust Accounting, Version 2020

No comments

We are looking for firms to provide early feedback on Tabs3 version 2020. The following features will be available in Tabs3 Version 2020:

- LawPay

- Tabs3 Billing – LawPay integration adds a new option for processing electronic payments and client funds deposits

- Trust Accounting Software (TAS) – LawPay integration adds a new option for processing electronic Trust deposits

- Dashboards

- Tabs3 Billing – displays Aged Accounts Receivable, Unbilled work, and graphs comparing the last two years of Cash Receipts and Billing History

- Accounts Payable Software (APS) – displays Unpaid Invoices, Unposted Checks and EFTs, and the total Paid this Month with shortcuts to Print Checks, Post Checks, and the Check Register report

- General Ledger Software (GLS) – displays an overview of your Bank Accounts and a list of Recent Bank Transactions

- Trust Accounting Software (TAS) – displays an overview of your Bank Accounts and a list of Recent Trust Transactions

- Positive Pay

- Positive Pay export from APS and TAS helps provide fraud protection

If you are using Version 19 and are on maintenance, you can jump on board early with these new features. To sign up, visit Tabs3.com/prerelease. If you have any questions, please email signup@tabs3.com.

Announcement: Tabs3 Version 2020 Coming Soon!

July 2019 Tags: Accounts Payable, Checks, Client Funds, Credit Cards, General Ledger, LawPay, Payments, Positive Pay, Reports, Tabs3 Billing, Trust Accounting, Version 2020

No comments

We are looking for firms to provide early feedback on Tabs3 version 2020. The following features will be available in Tabs3 Version 2020 later this year:

- LawPay

- Tabs3 Billing – LawPay integration adds a new option for processing electronic payments and client funds deposits

- Trust Accounting Software (TAS) – LawPay integration adds a new option for processing electronic Trust deposits

- Dashboards

- Tabs3 Billing – displays Aged Accounts Receivable, Unbilled work, and graphs comparing the last two years of Cash Receipts and Billing History

- Accounts Payable Software (APS) – displays Unpaid Invoices, Unposted Checks and EFTs, and the total Paid this Month with shortcuts to Print Checks, Post Checks, and the Check Register report

- General Ledger Software (GLS) – displays an overview of your Bank Accounts and a list of Recent Bank Transactions

- Trust Accounting Software (TAS) – displays an overview of your Bank Accounts and a list of Recent Trust Transactions

- Positive Pay

- Positive Pay export from APS and TAS helps provide fraud protection

If you are using Version 19 and are on maintenance, you can jump on board early with these new features. To sign up, visit Tabs3.com/prerelease. If you have any questions, please email signup@tabs3.com.

Video of the Month: Getting Paid Using Online Payments

June 2019 Tags: Credit Cards, Email Statements, Payments, Resources, Version 19

No comments

Do you want to get paid faster? Get paid quickly and securely by providing an online payment option to your clients!

In Version 19 we added the ability to include a ProPay payment link in your email statements. This provides a secure way for your clients to pay with a credit card when they check their email and see they owe your firm money. Once a payment is made online, import the payment into Tabs3 Billing, and you’re done!

The Getting Paid Using Online Payments video shows you an email statement template that includes a ProPay link, the ProPay payment portal, and then shows you how to import payments made via ProPay links into Tabs3. It’s never been easier to get paid!

Watch this two-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos while in the software by selecting Help | Training Videos.

KB Corner: Using the Tabs3 Payment Link

February 2019 Tags: Email Statements, Payments, ProPay, Resources, Tabs3 Billing, Version 19

No comments

Did you know that if you use ProPay to process credit cards in Tabs3, you can now send a link to your clients so they can make a payment without you needing to get their credit card information? Once the payment is made by your client, you can then import those payment records into Tabs3 Billing.

This works by configuring your Email Statement template to automatically generate a personalized link to the ProPay website. The link can be used by your clients to pay their bills directly via credit/debit card or electronic check. Those payments can then be imported into Tabs3 using the new Import Online Payments feature.

Note: Each time an email is generated via the Email Statements program, a new and unique link is also generated specific to that client.

Knowledge Base Article R11767, “Using the Tabs3 Payment Link,” provides more information on how the Tabs3 Payment Link and Import Online Payments features work. Check out this article to learn how to modify your email template, process and email your statements, import online payments, and read frequently asked questions.

Our Knowledge Base can be accessed 24 hours a day, 7 days a week, at support.Tabs3.com. You can also access our Knowledge Base while in the software by selecting Help | Internet Resources | Knowledge Base.

Spotlight: Transfer A/R and Transactions

December 2017 Tags: Clients, Costs, Fees, Payments, Tabs3 Billing

No comments

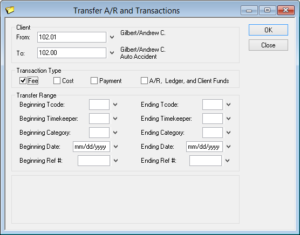

Occasionally, transactions may accidentally be entered for the wrong client. If there are only a couple, it’s easy to just delete them and reenter them for the correct client. However, when there are many transactions, what can you do? Use the Transfer A/R and Transactions utility in Tabs3!

The Transfer Transactions program can be used to transfer unbilled fees, costs, and/or payments between clients. When selecting to transfer fees, costs, and/or payments, you can select a range of transactions based on tcode, timekeeper, category, date, and/or reference number. This can help make sure that you are only transferring the transactions that you want to transfer.

Additionally, if a time comes when you want to transfer one client’s full accounts receivable balance, ledger, archived transactions, and client funds to another client, the Transfer A/R and Transactions utility can also be used. This function will transfer ALL of the client’s ledger records and billing history to another client. It is not possible to only transfer a client’s current A/R without also transferring everything else.

Note: When using the Transfer A/R and Transactions utility, keep in mind that once the transfer has been performed, the only way to undo it is by restoring from a backup.

To transfer transactions between clients

- From the Maintenance menu, select Transfer A/R and Transactions.

- Select the clients you want to transfer From and To.

- Select the desired Transaction Type(s).

- Optionally select a Transfer Range.

- Click OK.

Keep this utility in mind the next time transactions need to be transferred from one client to another client. It can save you significant time.

Quick Tip: Credit Card Form on Statements

September 2017 Tags: Credit Cards, Payments, Statements, Tabs3 Billing

No comments

If you accept credit cards, do you have a credit card form on the statements you send to your clients? Many clients prefer to pay by credit card, and if there isn’t an easy way to do so, you may not be getting paid as quickly as you could be.

So how can you include a credit card form on the statements you send to your clients?

Statement Designer (Statements | Statement Setup | Statement Designer) provides two layouts that have a place at the bottom of the page to fill out credit card information: CC Payment Remittance and Remittance Page. Simply edit one of these layouts as desired for your firm’s needs, and then include it on the statement templates (Statements | Statement Setup | Statement Templates) you use for your clients.

For more information on editing Statement Designer Layouts, refer to Knowledge Base Article R10901, “Customizing the Sample Page Layouts Provided with the Tabs3 Statement Designer.”

The next time you send out statements, clients can send the credit card form back with their information and you may very well get paid sooner!

KB Corner: Fixing Misapplied Payments and Credits

August 2017 Tags: Credits, Payments, Reports, Resources, Tabs3 Billing

No comments

You run an Accounts Receivable Report only to see clients or figures you weren’t expecting. Other reports, such as a Client Ledger Report, may show a client owes you a different amount or nothing at all, but Accounts Receivable tells a different story. Why is this, and how can you fix the issue?

When payments and credits are misapplied, Accounts Receivable reports can show unapplied payments, negative due values, or both. But what are misapplied payments and credits?

- Misapplied payments are payments that have been entered but were unable to apply. Most often this occurs when a payment is entered specifically as a fee payment and there are either no fees or not enough fees for the payment to apply to, or the payment is entered as an expense/advance payment and there are no expenses/advances or not enough expenses/advances for the payment to apply to.

- Misapplied credits occur when a credit is entered and there is nothing to apply the credit toward. Credit transactions only apply toward fees or costs for which payments have not yet been applied. Once a payment has applied toward a transaction that has been final billed and updated, credits entered after that can only apply when a new transaction of the same type as the credit is entered.

To determine whether unexpected figures in Accounts Receivable Reports are caused by misapplied payments, credits, or both, visit Knowledge Base Article R11673, “Fixing Misapplied Payments and Credits.” This article provides information on determining the cause and how to fix both issues.

Our Knowledge Base can be accessed 24 hours a day, 7 days a week, at support.Tabs3.com. You can also access our Knowledge Base while in the software by selecting Help | Internet Resources | Knowledge Base.

Spotlight: Automatic Trust Payments

May 2017 Tags: Payments, Statements, Tabs3 Billing, Trust Accounting

No comments

Do you want a way to streamline trust payments to Tabs3 Billing? Trust Accounting Software (TAS) provides the ability to automatically draw funds from a trust account when final statements are generated in Tabs3.

You will no longer need to enter payments to Firm from TAS; simply enter your transactions in Tabs3, and then bill like normal. As final statements are generated in Tabs3, the software will automatically create trust transactions and Tabs3 payment records based on the client’s due amounts. This feature can be enabled or disabled on a global level, at the bank account level, and at the trust account level. You can specify whether to pay work-in-process, accounts receivable, or both; whether to pay fees, expenses, or advances from these amounts; and whether to create check or EFT transactions in TAS for these amounts.

Note: We recommend consulting your local Bar Association before enabling Automatic Trust Transactions to ensure that you are complying with local trust regulations.

To implement Automatic Trust Payments, you will need to enable TAS Integration in Tabs3 and then configure TAS Customization, the desired TAS Bank account(s), and the desired Trust Account(s). For complete step-by-step instructions on setting up Automatic Trust Payments, refer to the Integration Guide or the Automatic Trust Payments Overview topic in the TAS Help.

Watch this three-and-a-half-minute video here:

Training Videos can be accessed 24 hours a day, 7 days a week, at Tabs3.com/videos. You can also access Training Videos while in the software by selecting Help | Documentation and then clicking the See also link for Tabs3 and PracticeMaster Training Videos.

KB Corner: Credit Card Refund Best Practices

July 2016 Tags: Best Practices, Credit Cards, Payments, Refunds, Resources, Tabs3 Billing, Trust Accounting, Version 18

No comments

When you need to refund or reverse credit card payments, you want to be able to do it with the least amount of hassle. Tabs3 Billing and Trust Accounting Software (TAS) are designed to automatically issue a ProPay refund or reversal when appropriate.

Knowledge Base Article R11708, “Credit Card Refund Best Practices,” provides information on how ProPay handles credit card reversals and provides processes for reversing, refunding, or deleting credit card payments or transactions in Tabs3 Billing and TAS.

Be sure to check out this article so that you are using the recommended methods to refund or reverse ProPay credit card payments.

Our Knowledge Base can be accessed 24 hours a day, 7 days a week, at support.Tabs3.com. You can also access our Knowledge Base while in the software by selecting Help | Internet Resources | Knowledge Base.

Quick Tip: Apply Payments to Multiple Matters

December 2015 Tags: Clients, Payments, Tabs3 Billing

No comments

When you have a client with multiple matters, what do you do when the client sends in a single check to cover all matters? You could get out the calculator to determine how much should go to each matter, and then enter multiple payment records, or you could let Tabs3 Billing do this for you.

When entering a payment for multiple matters, simply enter the payment for one of the matters and then click the ![]() (Apply Payment to Multiple Matters) button to open the Payment Amounts for Multiple Matters window. Here, you can either enter each Client ID and the corresponding amount of the matter’s Payment, or you can click the Apply Proportionately button to divide the payment amount between all matters shown proportionately based on the amount due.

(Apply Payment to Multiple Matters) button to open the Payment Amounts for Multiple Matters window. Here, you can either enter each Client ID and the corresponding amount of the matter’s Payment, or you can click the Apply Proportionately button to divide the payment amount between all matters shown proportionately based on the amount due.

Recent Comments

- Tabs3 Software on Feature Article: Year-End is Fast Approaching!

- Linda Thomas on Feature Article: Year-End is Fast Approaching!

- James Hunter on Spotlight: Reorder Fees

- Tabs3 Software on Video of the Month: PracticeMaster Conflict of Interest

- Stephanie Biehl on Video of the Month: PracticeMaster Conflict of Interest