Spotlight: Tabs3 Cloud

June 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Tabs3 Cloud, Trust Accounting

No comments

Tabs3 Cloud is a cloud-based legal billing and financial software solution designed specifically for the way today’s fast-paced, multifaceted law firms operate. It includes all the benefits of the Platinum edition of our Tabs3 Billing, PracticeMaster, and Financials software so you can manage your firm more effectively.

The following are just some of the benefits of Tabs3 Cloud:

- Managed by Tabs3 – With Tabs3 Cloud, the Tabs3 Software is installed and managed by the Tabs3 Team. You don’t need to purchase and maintain a server computer. If your firm has IT staff or network administrators, they will not be responsible for managing Tabs3 Cloud beyond ensuring you can access the software via the internet.

- Automatic Backups – With Tabs3 Cloud, the Tabs3 Software is automatically backed up throughout the workday, along with a daily archival backup that is stored offsite. In the event you need to restore from a prior backup, Tabs3 Support will handle the restore process and notify you when Tabs3 Cloud is available again.

- Simple Pricing – Tabs3 Cloud is offered on a per user basis.

- Data Privacy – Tabs3 Cloud secure login uses multi-factor authentication to control access to your firm’s data.

- Software updates are handled by the Tabs3 Team – The Tabs3 Team will keep Tabs3 Cloud up to date.

Propel your firm toward higher profits with reliable software that’s designed specifically for law firms like yours.

Tabs3 Cloud includes all of the features you trust from Tabs3 Software and puts them on your browser in the same easy-to-navigate interface you’re familiar with.

Whether you’re a longtime Tabs3 Software user or switching from another billing tool, Tabs3 Cloud is the perfect solution to keep your firm running.

Discover what the most dependable software solution for billing and financials on the market can do for your legal practice.

To learn more about Tabs3 Cloud, visit Tabs3.com/Cloud, check out Knowledge Base Article R11941, “All About Tabs3 Cloud,” or watch the Introducing Tabs3 Cloud video. To get pricing or to purchase a Tabs3 Cloud subscription, contact your local consultant or contact our Sales department at 402-419-2200.

Note: Tabs3 Software is available in Tabs3 Cloud or on-premises.

KB Corner: Version 2025 Introduction to New Features

May 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Resources, Tabs3 Billing, Trust Accounting, Version 2025

No comments

Want to see all of the new features in Version 2025? Check out Knowledge Base Article R11975, “Introduction to New Features!”

This article provides information on each new feature. Features are listed by application and include screenshots and links to additional information when applicable. Each time we add a new feature to Version 2025, this article is updated so that you can get the information you need to begin using the feature.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Quick Tip: Tabs3Pay Tips

May 2025 Tags: Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

Did you know that Tabs3Pay can help you get paid faster? Accepting credit cards helps make it easier for clients to pay their bills. Sign up directly from Tabs3 Billing or Tabs3 Trust Accounting; in the Quick Launch, search for and select “Tabs3Pay Web Portal.”

With Tabs3Pay, you can:

- Manage separate trust and operating accounts.

- Securely store payment information for future use.

- Accept credit cards and electronic checks, all from within Tabs3 Software.

- Include a payment link in email statements, allowing your clients to easily enter payment information through the secure Tabs3Pay portal.

- Include trust replenishment request links with email statements or generate email requests directly from the Tabs3 Billing Matter Manager using Request Trust Deposit.

- Schedule future or recurring payments for clients.

- Take advantage of the Surcharging feature, allowing you to minimize the expense of processing fees.

- Enable clients to pay their current balance from the Tabs3 Client Portal.

To learn more about Tabs3Pay, visit Knowledge Base Article R11871, “Tabs3Pay Frequently Asked Questions,” or R11869, “Configuring Tabs3Pay.”

Feature Article: Version 2025 is Here!

April 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting, Version 2025

No comments

Version 2025 has some great new features to check out!

Tabs3 Billing Highlights

- Pre-Bill Tracking – Made multiple improvements to pre-bill tracking and the statement review process.

- Generate Statements – Added a new Pre-Bill option in Generate Statements to improve the paperless review process in the Pre-Bill Tracking window. Pre-bills streamline the review process and prevent unintended transaction changes.

- Statement Information – Added the ability to preview pre-bills and final statements in the Pre-Bill Tracking window using drill-down via the date columns to enhance accessibility. The Pre-Bill or Final Statement Information window also includes the Take Action pane, providing quick links to common actions.

- Transaction Protection – Transactions in pre-bills are protected, allowing users to make changes during the review process by drilling down to the transaction in the Pre-Bill tracking window. For changes to be made outside of Pre-Bill tracking, users must be assigned a new access right “Modify Pre-Bill Transactions Outside of Pre-Bills.”

- Statement Comments – Added a Comments pane in the Pre-Bill Information and Final Statement Information windows, allowing users to view and add comments during the review process. The pane’s icon displays a notification badge when there are unread comments, ensuring important notes are easily noticed.

- Transactions on Statements – Added “Pre-Bill” and “Final Statement” hyperlinks to the upper-right corner of entry windows to identify transactions included on a pre-bill or final statement. Users with rights to View Statements will be able to open the pre-bill or final statement using this link.

- Task Based Budgets – Added an Edit Task Based Billing Budget link to the Take Action pane in Matter Manager. Also added a new access right to control who has the ability to use this link.

- Fee Recap – Added column sorting to the Fee Recap Lookup window making it easy to group records when verifying hours.

PracticeMaster Highlights

- Document Preview – Added the ability to preview documents in the SnapShot pane when viewing Document Management lists.

- Archived Fees and Costs – Added the option to limit the range of archived fees and costs synchronized from Tabs3 Billing by date. This is particularly useful when adding PracticeMaster to an existing Tabs3 Billing system.

- Fee and Cost History – Fee and cost custom field and history tracking information is now retained when fee and cost transactions are archived (final billed and updated).

- Meeting Attendees – Updated the Dashboard to display the attendees for Outlook meetings in the tooltip.

- Fee Recap – Added column sorting to the Fee Recap Lookup window making it easy to group records when verifying hours.

Accounts Payable Highlights

- Costs on Statements – Added “Pre-Bill” and “Final Statement” indicators to the upper-right corner of the Cost Transactions window to identify transactions that cannot be edited in AP because they are included on a pre-bill or a final statement.

Tabs3 Taskbill Highlights

- Contact Initials – Added the ability to override a timekeeper’s initials using a custom field in the PracticeMaster Contact file.

Tabs3 Platinum Software Highlights

- Multi-Factor Authentication – Added the option to enable and configure multi-factor authentication (MFA) for individual Tabs3 Connect users.

All Tabs3 Software

- Access Right – Added a new access right “Modify Pre-Bill Transactions Outside of Pre-Bills.” Users, including Managers, will need assigned this new access right in order to edit transactions included on pre-bills from outside the Pre-Bill Information window.

For in-depth information on all of the new Version 2025 features, including screenshots, refer to Knowledge Base Article R11975, “Version 2025 Introduction to New Features.” A list with links to all Version 2025 information can be found in R11977, “Version 2025 Information and Resources.”

To download Version 2025, check for updates via the Quick Launch by searching for and selecting “Check for Updates” or via the Help | Check for Updates menu option, or contact your local consultant.

Quick Tip: Popup Calculator

April 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

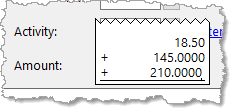

Did you know there is a calculator built into number and amount fields? When your cursor is in any number or amount field, you can use the math operators (+, -, *, /, or =) to add, subtract, multiply, and divide values just as you would on a calculator. When you press Enter, the total of your calculations will be displayed in the field that you are currently in. This feature can be used to easily perform calculations without using a separate calculator. The popup calculator can be accessed from a number or amount field by pressing M or one of the math operators.

Did you know there is a calculator built into number and amount fields? When your cursor is in any number or amount field, you can use the math operators (+, -, *, /, or =) to add, subtract, multiply, and divide values just as you would on a calculator. When you press Enter, the total of your calculations will be displayed in the field that you are currently in. This feature can be used to easily perform calculations without using a separate calculator. The popup calculator can be accessed from a number or amount field by pressing M or one of the math operators.

Feature Article: Customizing My Actions

March 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

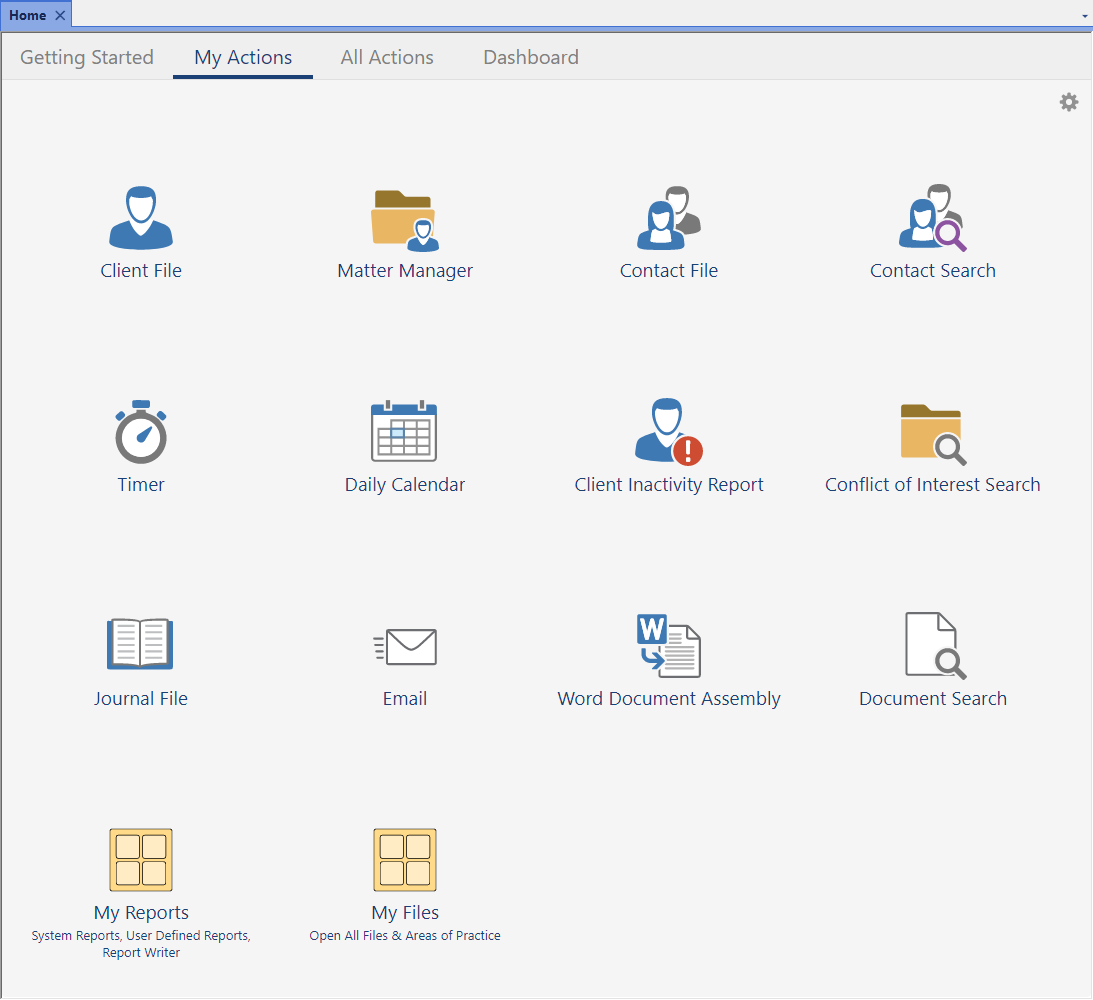

What if you could create a personalized workspace in each Tabs3 Software application, giving you quick access to your most frequently used features? With My Actions, you can!

The My Actions page view of the Home Page can be customized to display the features you use most, including reports. You can even create groups of features for easy categorization! My Actions can be customized in Tabs3 Billing, PracticeMaster, Trust Accounting (Trust), Accounts Payable (AP), and General Ledger (GL).

Customizing Actions

Add your favorite features for quick access.

To add an action

- Click the

(Customize My Actions) icon.

(Customize My Actions) icon. - Click the Add Actions button.

- Select the desired features in the Available Actions column.

- Click the Add button to move them to the Actions to Add column.

- Click Finish on the Add Actions window.

- Click Finish on the My Actions tab.

You can also add actions by right-clicking an item in Quick Launch and selecting Add to My Actions, or by hovering over an action on the All Actions tab and clicking the ![]() star.

star.

To remove an action, click the ![]() (Customize My Actions) icon and then click the

(Customize My Actions) icon and then click the ![]() minus sign on the action you want to remove.

minus sign on the action you want to remove.

Groups

Groups can be created to help categorize your favorite programs. For example, you could create groups for Daily Tasks, Monthly Reports, or Year-End just to name a few! Assign a color to the folder to make identification easier.

To create a group

- Click the

(Customize My Actions) icon.

(Customize My Actions) icon. - Click the Add Group button.

- Enter the desired group Name.

- Optionally enter a Description.

- Select the desired Color.

- Click Next.

- Select the desired features in the Available Actions column, click the Add button to move them to the Actions to Add column, and then click Finish.

You can add actions to an existing group by dragging and dropping an action onto the group icon, or by clicking the group and then clicking the Add Actions button.

To remove a group, click the ![]() (Edit Group Properties) icon and click the Delete button.

(Edit Group Properties) icon and click the Delete button.

Want to see it in action? Check out the four minute Using and Customizing My Actions video:

KB Corner: Keeping Tabs3 Software Up To Date

March 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Resources, Tabs3 Billing, Trust Accounting

No comments

Updating Tabs3 Software is as easy as one-two-three! Although major version releases introduce new features and enhancements, interim updates provide additional improvements throughout the year. These updates are designed for quick installation with little to no downtime for your office. Simply select Help | Check for Updates in the software.

For additional information on checking for updates, downloading an update, and installing an update, refer to Knowledge Base Article R11937, “Keeping Tabs3 Software Up to Date.”

Access our Knowledge Base at support.Tabs3.com, or find it in the Quick Launch by searching for and selecting “Knowledge Base.”

Stay up to date and take advantage of the latest features and improvements!

Spotlight: Updating Firm Information

March 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Firm information can change for many reasons, such as when you move, add partners, or the firm splits. Updating the software with your new information is important so that your firm is accurately represented on statements, checks, and more. Informing Tabs3 Software is also important so that information regarding changes to the software reaches you in a timely manner.

The main changes to firm information are made in System Configuration; however, other changes may also be necessary depending on your use of the software and are outlined below.

System Configuration

You can change your firm’s name, address, phone, website, and Federal ID # in System Configuration’s Firm Information window (File | Open | Firm). Changes to the firm’s name, address, Federal ID #, or phone will prompt you to print and send us a form with the changes. This is so that we can update our records.

Making changes to the Firm Information will automatically change the following information in the software:

- Heading of all reports in Tabs3 Billing, PracticeMaster, Trust Accounting (Trust), and Accounts Payable (AP).

- Firm name displayed on Trust and AP 1099 Forms.

- Firm name printed on Trust checks to your firm.

- Statement Designer layouts that use a variable for any of the fields that have changed.

- Document Assembly templates and report definitions that use any of the fields that have changed.

Note: When a change to the firm name is made in the Platinum edition, all users must exit the Tabs3 Software before the change will apply to the Tabs3 Software report headings or Trust checks to your firm.

Tabs3 Billing

The following changes to statement information may need to be made in Tabs3 Billing for changes to your firm’s information.

- If your firm uses the Headings tab in Statement Customization (In the Quick Launch, search for and select “Statement Customization”) to enter up to nine lines to be printed as a heading on each statement, these lines may need to be updated.

- If your firm uses Statement Designer layouts that provide firm information manually entered, instead of using variables, these layouts may need to be updated.

- If your firm uses bitmaps on statements that include the changed firm information, the bitmaps will need to be recreated.

General Ledger (GL)

In GL, the Client Name field in the Edit GLS Client utility (In the Quick Launch, search for and select “Edit GLS Client”) prints as a heading on all GL reports.

Tabs3 Remote

In Tabs3 Remote, the firm name is saved in Customization (Utilities | Customization) and is printed as a heading on all Tabs3 Remote reports.

If your firm information changes, make sure you update all of the necessary areas to help make the transition smooth.

Quick Tip: Support Log

March 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Reports, Tabs3 Billing, Trust Accounting

No comments

Did you know that some activities are logged in the software, such as when the software is backed up or restored? This information can come in handy when you want to determine when something happened and who initiated it.

A Support Log is available for viewing or printing in every application, but provides different information based on the application. Not all activities are logged, but those that have a high impact are typically included.

To print a Support Log

- In the Quick Launch, search for and select “View the Support Log.”

- Optionally enter a Date range.

- Optionally select the Specific option next to Users, and then select the desired users for whom you want the report to run.

- Optionally select the Specific option next to Features, and then select the desired features for which you want the report to run.

- Click the Print button.

There are many helpful features in the Support Log. For example, let’s say you are sure that you updated statements last week, but now those transactions are showing as work-in-process again. In Tabs3 Billing, you can print the Support Log and include the Undo Updated Statements feature. When reviewing the report, you will see a list that includes every time Undo Updated Statements has been run. The following information will also be included: Date, Time, User, Statement, Cnt (Count), Client Range, and Reporting Month. Now you can see who undid the statements and talk to them to find out why.

To view a complete list of what features are included in the Support Log for each application, visit Knowledge Base Article R11288, “Support Log Information.”

Spotlight: Process Payments with Tabs3Pay

March 2025 Tags: Credit Cards, Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

Your clients use credit cards, and accepting payments from them has never been easier for your law practice. With Tabs3Pay features such as easy invoicing, next day funding, scheduled payments, surcharging, and more, all within Tabs3 Software, you can make payments effortless for your clients and get paid faster. Tabs3Pay setup is quick and hassle-free. And because credit card processing fees can impact your firm’s profitability, we offer surcharging as a cost-saving solution.

With Tabs3Pay you can:

- Accept credit cards and electronic checks within Tabs3 Software.

- Reduce credit card expenses with optional surcharging – process unlimited credit cards for as low as $50.

- Manage separate trust and operating accounts from Tabs3 Software.

- Securely store payment information for future use.

- Email an invoice with a secure payment link.

- Send statements with a payment QR Code.

- Schedule future and recurring Tabs3Pay payments.

- Request Trust replenishment.

Other Benefits Include:

- Get paid faster.

- Eliminate manual errors.

- Save time and collection hassles.

- Certified PCI compliant and secure.

To sign up for Tabs3Pay

- In the Tabs3 Billing or Trust Quick Launch, search for and select “Tabs3Pay Web Portal.”

- Click the Let’s Get Started button.

For more information on signing up for and configuring Tabs3Pay, see Knowledge Base Article R11869, “Configuring Tabs3Pay.”

*Surcharging laws vary by state and are subject to change. Always check with your local bar association for the most updated information.

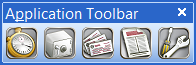

Quick Tip: Application Toolbar

February 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Did you know that you can quickly start other Tabs3 Software applications from within any application? Once you have opened one of the Tabs3 Software applications, simply click on the desired application button in the application toolbar! The application toolbar is located at the bottom of the Quick Launch pane.

![]()

When starting any application from the application toolbar, the new software will use the same User ID as the current application. An application’s button will not be displayed on the application toolbar if you do not have access rights to that application or if it is not installed on your workstation.

KB Corner: Moving Tabs3 Software from One Computer to Another

January 2025 Tags: Accounts Payable, General Ledger, PracticeMaster, Resources, Tabs3 Billing, Trust Accounting

No comments

Are you planning on purchasing a new server, or moving from one computer to another? Sometimes it becomes necessary to move the Tabs3 Software from one location on the network to another location. Knowledge Base Article R11895, “Moving Tabs3 Software,” and Knowledge Base Article R11896, “Moving Tabs3 Platinum Software,” walk you through the steps to move the software to a different computer.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Feature Article: Year-End is Fast Approaching!

December 2024 Tags: Accounts Payable, General Ledger, Tabs3 Billing, Trust Accounting, Year-End

2 Comments

With 2024 coming to a close, year-end tasks are also swiftly approaching. Get a jump on 2025 by reviewing the recommended year-end procedures! As always, look no further than our Knowledge Base and Help topics to guide you through the process.

Knowledge Base Article R10429, “Year-End Overviews for Tabs3 Software Products,” includes links to KB articles that provide checklists and frequently asked questions. The types of questions found in each year-end article are outlined below:

Tabs3 Billing – R11693

- Retaining Previous Year’s Information

- Next Year’s Entries

- GL Integration

Tabs3 Trust Accounting – R10433

- Bank Account Reconciliation

- Reports

- 1099s, including E-file

- GL Integration

Tabs3 Accounts Payable – R11278

- Checks

- Void Posted Checks

- Reports

- 1099s, including E-file

- Deleting Vendors

- GL Integration

Tabs3 General Ledger – R11600

- Advancing the Year

- Reports

Lists of basic year-end procedures are also available in Help for each Tabs3 Software application. Simply enter the keyword “year-end” on the Index tab to display the year-end procedures Help topic.

KB Corner: Ordering Form 1099-MISC from Nelco

December 2024 Tags: Accounts Payable, Resources, Trust Accounting, Year-End

No comments

It’s almost 1099 season! If you don’t want to E-file, and you have 10 forms or fewer to send, continuous 1099 Forms can be ordered directly from the IRS. However, for laser printer forms, we recommend ordering 1099 forms from Nelco. These forms are guaranteed to be 100% compatible with AP and Trust. Likewise, you can order W-2 Wage and Tax Statement laser forms from Nelco. Now is a good time to take inventory of your 1099 forms, AP checks, and Trust checks so you can order them all at the same time! Nelco has over 50 years of experience in the business forms industry.

Knowledge Base Article R10978, “Ordering Tabs3 Software Compatible Checks and Forms from Nelco,” includes which forms are compatible with Tabs3 Software and links you to the Nelco website where you can order them.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Spotlight: Tabs3 1099 E-file

December 2024 Tags: 1099s, Accounts Payable, Trust Accounting, Year-End

No comments

Tax time is stressful for everyone, but especially for businesses. Tabs3 Software has partnered with Nelco® to provide Tabs3 E-file, a complete solution to filing your forms 1099-MISC, 1099-NEC, and 1096. You don’t need to deal with the forms, envelopes and postage, or configuring your printer at your office; instead, simply upload your data to the Tabs3 E-file portal and they can be electronically filed, printed and mailed, or emailed on your behalf, saving you time and manpower every year.

To transmit Form 1099-Misc and Form 1099-NEC to the Tabs3 E-file portal

- From the Accounts Payable Quick Launch, search for and select “Tabs3 1099 E-file.”

- Optionally specify a Minimum YTD Amount other than 600.

- In the Trust Transactions section, optionally select Merge transactions where Firm is the payer and/or Include transactions where Trust Account is the payer. (Note: Tabs3 E-file can also be started from Tabs3 Trust Accounting, with similar options.)

- Click Transmit.

- Log in with your Tabs3 E-file account information.

- In the Forms in Progress section, select the desired options and click Next.

- Verify your information is correct and click Next.

- Enter your payment information and click the Pay & Submit button.

Prefer not to use the Tabs3 E-file portal? No problem! Tabs3 Accounts Payable (AP) and Tabs3 Trust Accounting (Trust) allow you to view 1099 information on reports, print Form 1099-MISC or Form 1099-NEC for filing, or create a 1099 Disk File which can be used to electronically file with the IRS. Using both AP and Trust together allows you to create a combined file by merging your Trust data into AP to run one set of 1099 forms or create a single electronic file.

Video: Accepting Electronic Payments with Tabs3Pay

December 2024 Tags: Credit Cards, Resources, Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

Did you know that law firms who accept credit cards get paid sooner and collect on more billable work than firms that don’t?

With Tabs3Pay, accepting and managing electronic payments has never been easier for your law practice! Not only can you accept credit cards and electronic checks, but you can manage separate trust and operating accounts, and securely store payment information for future use. Additionally, by including a payment link in email statements, your clients can easily enter payment information through the secure Tabs3Pay portal.

Watch this six-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos in the Quick Launch by searching for and selecting “Training Videos.”

KB Corner: All About Tabs3 Cloud

December 2024 Tags: Accounts Payable, General Ledger, PracticeMaster, Resources, Tabs3 Billing, Tabs3 Cloud, Trust Accounting

No comments

Tabs3 Cloud is a fully integrated practice management suite that includes Tabs3 Billing, Financials, and PracticeMaster. With Tabs3 Cloud, your Tabs3 Software data is accessible from any internet connection, at any time. Enjoy the freedom to work from your office, home, or on the go, all within a secure environment. Experience the full functionality and data privacy of Tabs3 Software without having to worry about servers or backups.

Knowledge Base Article R11941, “All About Tabs3 Cloud,” includes the benefits of Tabs3 Cloud, what’s included, and how it works, as well as performance, licensing, and general information.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Quick Tip: Quick Launch

November 2024 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

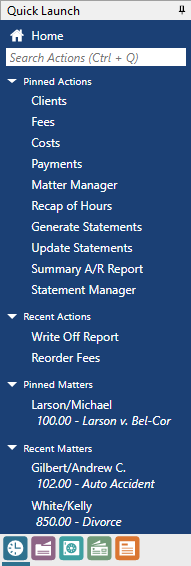

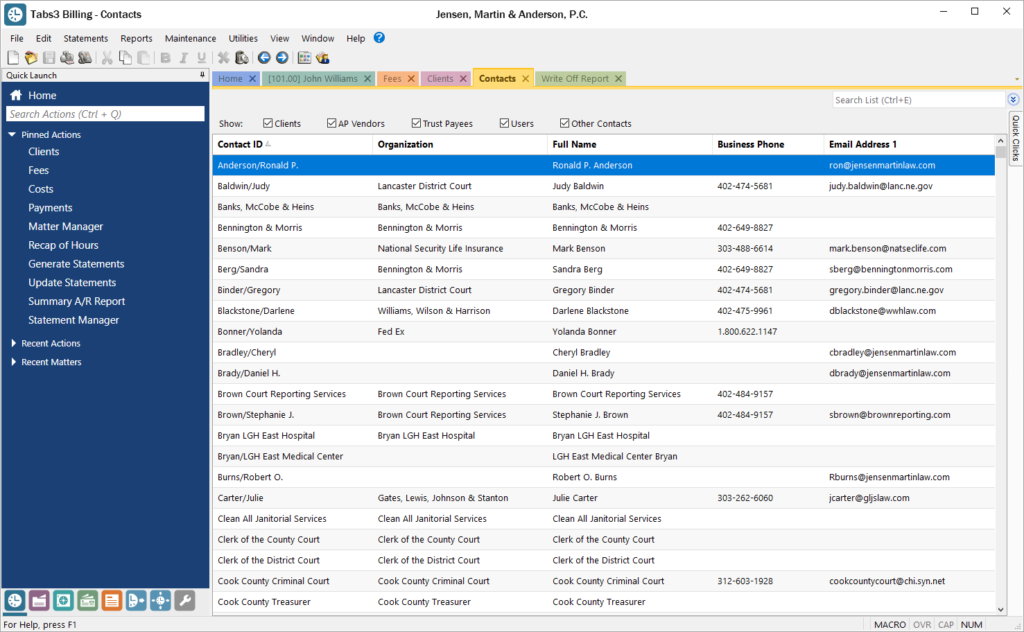

Do you sometimes forget where to access features or reports in the software that you only use occasionally? Use the Quick Launch to find what you need!

The Quick Launch provides a Search Actions field to quickly find actions in the current application. Simply start typing, and a list of possible choices that contain the characters entered will be displayed, allowing you to easily select an action to launch. For example, searching for “check” will include Check for Updates and Data File Integrity Check in the list of options. In addition to the feature names, common acronyms and alternate references are included. For example, searching for “attorney” in Tabs3 Billing will include all references to “timekeeper” in the list such as Timekeeper Information, Timekeeper Productivity Report, etc.

In addition to search capabilities, the Quick Launch displays the most recent actions and matters accessed and provides the ability to pin actions and matters. To pin an action or matter, hover over the item and click the ![]() icon. Pinned actions or matters are removed from the Recent Actions or Recent Matters sections and added to the Pinned Actions or Pinned Matters sections. Pinned items can be reordered by dragging them to the desired position in the list. To unpin an action or matter, hover over the item and click the

icon. Pinned actions or matters are removed from the Recent Actions or Recent Matters sections and added to the Pinned Actions or Pinned Matters sections. Pinned items can be reordered by dragging them to the desired position in the list. To unpin an action or matter, hover over the item and click the ![]() icon.

icon.

Another great feature is the ability to access other applications using the application icons at the bottom of the Quick Launch pane. This provides quick access to all of the Tabs3 Software installed. No need to find the shortcut on your desktop or in the Start menu.

Tip: You can instantly access the Search Actions box by pressing Ctrl+Q.

Feature Article: PracticeMaster is Now in the Cloud!

October 2024 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Tabs3 Cloud, Trust Accounting

No comments

Tabs3 Cloud is a cloud-based legal billing and financial software solution designed specifically for the way today’s fast-paced, multifaceted law firms operate, and PracticeMaster is now available to provide a complete suite of Tabs3 Software applications!

With this new release, users have more ways to access the powerful features and tools that have transformed the way legal professionals work, in addition to the cloud-based billing and financial tools already accessible in Tabs3 Cloud.

Features include:

- Matter management tools

- Legal calendaring

- Document management

- Document assembly

- And more

Contact Sales at (402) 419-2200 for more information, or sign up for a demo at Tabs3.com/cloud.

Note: Tabs3 Software is available in Tabs3 Cloud or on-premises.

Quick Tip: Marking Records Inactive

October 2024 Tags: Accounts Payable, General Ledger, Inactive, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Did you know that there are several record types throughout the software in which you can mark people or accounts as inactive? Selecting the Inactive check box provides the ability to keep the associated history, but removes the ability to accidentally add associated records. You can also typically choose whether or not you want to include inactive people or accounts on lookup windows and reports.

Records in the following files can be marked as inactive:

- System Configuration – Users

- Tabs3 Billing – Clients, Contacts, and Timekeepers

- PracticeMaster – Clients and Contacts

- General Ledger Software (GLS) – Chart of Accounts

- Accounts Payable Software (APS) – Vendors and Bank Accounts

- Trust Accounting Software (TAS) – Contacts and Bank Accounts (Note: Clients must be marked as inactive in Tabs3 Billing)

For more information on marking records inactive, press F1 to open the Help, enter “inactive” on the Index tab, and select the desired topic.

Spotlight: Sample Report Packs

August 2024 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Do you ever wonder how figures on reports are calculated? Sample Report Packs take the mystery out of reporting. Sample reports are available for every Tabs3 Software application and each report is broken down field by field to explain exactly how the information is represented.

Each report consists of three sections: a sample report, the description of the report, and field definitions.

Sample Reports

At least one example is provided for each report so you can see how the report looks. More than one example is shown if there are significant differences in the formatting when different settings are selected.

Description

An overview of each report briefly explains the purpose of the report and provides a summary of available options. You can use the overview to help determine if the report suits your current reporting needs.

Definitions

The Definitions section for each report provides a detailed breakdown of every field available on the report. This may be as simple as a Date field on a report representing “The date the report was printed,” or a calculation based on multiple fields. For example, on the Client Analysis Report, the Effective Rate field shows that it is calculated as “Hourly billing rate based on original hours. (Fees Billed minus Fee Write Offs) divided by Original Hours.”

To access the Report Packs

- Open the report for which you want to view the Sample Report Pack.

- Press F1.

- Click the icon at the top of the Help topic (Report pack in PDF format).

When this icon is clicked, not only is the report pack opened, but you are taken directly to the page where the report is located. Alternatively, the Tabs3 Report Packs can be accessed via the Quick Launch by searching for and selecting “Documentation,” Help | Documentation, or Tabs3.com/docs.

Feature Article: Improved Logon Experience

May 2024 Tags: Accounts Payable, General Ledger, PracticeMaster, Security, Tabs3 Billing, Trust Accounting, Version 2024

No comments

In the Platinum SQL edition, users can now be linked to their Windows account. Using Windows Authentication instead of passwords allows an easier, more secure, logon experience.

For additional information about using a Windows account, see KB Article R11935, “Using Windows Authentication to Log in to Tabs3 Software.”

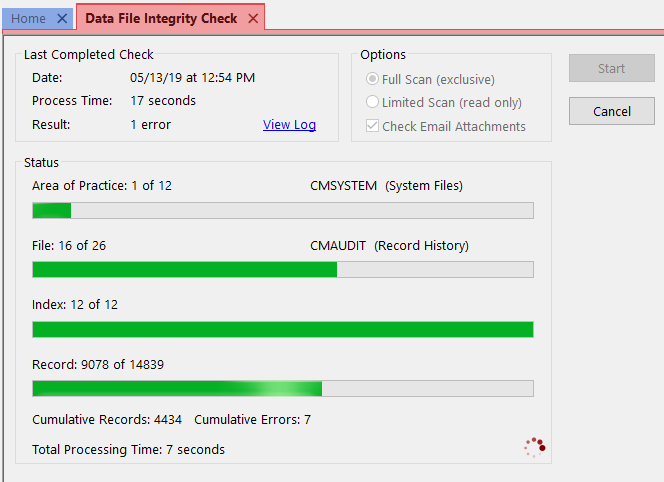

Tip: Now that User IDs can be associated with a Windows account, you can use the Windows Task Scheduler to automatically log into Tabs3 Software and perform tasks (such as Data File Integrity Checks) while maintaining security for all users. Additional information about using a Startup Option can be found in KB Article R11034, “Automating Tabs3 Software Maintenance Tasks” or the Help included with Tabs3 Software.

Version 2024 has some great new features to check out!

Tabs3 Platinum Software Highlights

- Added the ability to link your Tabs3 User ID to your Windows user account. Once you log into Windows, you can launch Tabs3 Software without having to enter another password. This allows you to use the Windows login security to ensure that only the associated user can access Tabs3 Software. (Requires Platinum SQL and an Active Directory Domain Server)

- Improved performance when refreshing or rebuilding PracticeMaster search indexes.

- Added the ability to schedule PracticeMaster search index rebuilds.

- Added the option to send an email notification when a search index rebuild fails or succeeds.

- Added the ability in PracticeMaster to rebuild the Conflict/Contact index file (used for Conflict of Interest Searching) while other users are in the software.

- Simplified the process of managing SQL ODBC access rights for users.

Tabs3 Billing Highlights

- Added new configuration options for Tabs3Pay payment links and request trust deposit links:

- Added the ability to specify if overpayments are allowed.

- Added the ability to specify if payments can be made by Credit Cards and/or eChecks/ACH.

- Made multiple improvements to the Tabs3 Billing Matter Manager:

- A final statement can now be updated by clicking the “1” badge in the Work-in-Process tile.

- Added a Perform Split Billing link to the Take Action pane. This link is only displayed when viewing the main Split Billing client.

- Added an Adjust Flat Fee Amount link to the Take Action pane. This link is only displayed when viewing a Flat Fee client.

- Added NetDocuments integration, allowing client information to be pushed to NetDocuments. This feature requires PracticeMaster Basic.

PracticeMaster Highlights

- Added the ability to synchronize event attendees from Outlook to PracticeMaster (when using the Microsoft 365 Exchange Connector).

- The Document Search index no longer needs to be rebuilt when a Renumber Client or Change Key Type is performed.

- Added the ability to select specific Journal record types when running a Conflict of Interest Search.

Tabs3 Trust Accounting Highlights

- Added new Positive Pay configuration options to support Wells Fargo Bank.

- Added new configuration options for Tabs3Pay payment links and request trust deposit links:

- Added the ability to specify if overpayments are allowed.

- Added the ability to specify if payments can be made by Credit Cards and/or eChecks/ACH.

Tabs3 Accounts Payable Highlights

- Added new Positive Pay configuration options to support Wells Fargo Bank.

Tabs3 Taskbill

- Added an option to export invoice attachments from Tabs3 Accounts Payable (AP) for costs included on a statement.

For in-depth information on all of the new Version 2024 features, including screenshots, refer to Knowledge Base Article R11947, “Version 2024 Introduction to New Features.” A list with links to all Version 2024 information can be found in R11949, “Version 2024 Information and Resources.”

To download Version 2024, check for updates via the Quick Launch by searching for and selecting “Check for Updates” or via the Help | Check for Updates menu option, or contact your local consultant.

Spotlight: Tabs3 Trust Accounting

March 2024 Tags: Checks, Deposit, Positive Pay, PracticeMaster, Reconciliation, Tabs3Pay, Trust Accounting

No comments

Tabs3 Trust Accounting (Trust) is designed to help your firm keep track of the trust accounts you manage.

- Trust tracks an unlimited number of client trust accounts, and can warn you when an account goes below a minimum balance.

- You can print checks, record manual checks, record electronic funds transfers (EFTs), record deposits, reconcile your bank account in the software, and track your trust transactions through a variety of reports.

- The 3-Way Reconciliation Report helps you stay compliant when balancing your accounts. Not only that, but Tabs3 Trust Accounting has a wide range of reports that can be customized to fit your needs.

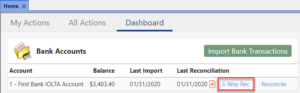

- Using the Tabs3 Trust Accounting Dashboard, you can easily stay on top of your Trust Account bank balances and quickly monitor any recent activity at a glance.

- Trust Accounting includes a Positive Pay Export program that allows you to export a list of all approved checks that can then be uploaded to your bank or financial institution’s fraud prevention program.

- The best way to accept credit card deposits for your firm is with Tabs3Pay. Securely make credit card or ACH deposits directly through Trust.

Trust provides seamless integration with Tabs3 Billing, PracticeMaster, Tabs3 Accounts Payable (AP), and Tabs3 General Ledger (GL).

- In Tabs3 Billing, trust balances can be shown in the Matter Manager and on work-in-process reports, trust transactions or balances can be shown on billing statements, and payments made to your firm from a client’s trust account can automatically generate a payment.

- Firms using Tabs3Pay can email a request to replenish the Trust balances at any time, giving clients a link to replenish their funds right away.

- In PracticeMaster, trust balances are shown as part of Matter Manager’s Billing Summary.

- In the Platinum edition, check requests can be created in PracticeMaster and sent to Trust.

- You can upload 1099 information to Nelco’s portal to make producing and sending 1099s a snap. Alternatively, IRS 1099 Forms (1099-MISC or 1099-NEC) information can be printed in Trust or be combined with AP 1099 information.

- Payments to the firm from Trust can create journal entries in GL. Additionally, accrual entries for Trust bank balances can optionally be posted in GL.

Trust accounting regulations require strict adherence. Tabs3 Trust Accounting provides peace of mind with the tools to help your firm manage your trust accounts. For more information, contact your local consultant, or contact our Sales Department at sales@tabs3.com.

Announcement: IRS Filing Changes for Tax Year 2023

November 2023 Tags: 1099s, Accounts Payable, Trust Accounting

No comments

The 1099 filing season is just around the corner. New for tax year 2023, the IRS is requiring that anyone filing an aggregate total of 10 or more forms (including Forms 1099-MISC, 1099-NEC, 1096, etc.) must file electronically. Corrections do not count towards this total; however, all corrections must be filed in the same manner as the originals, with penalties for failure to do so.

To prepare:

- Use Tabs3 E-file. Tabs3 Software has partnered with Nelco to provide Tabs3 E-file, a complete solution to filing your Forms 1099-MISC, 1099-NEC, and 1096. With Tabs3 E-file you don’t need to request a transmittal code from the IRS. You also won’t need to deal with forms, envelopes, postage, or configuring your printer; instead, simply upload your data to the Tabs3 E-file portal. From there, forms can be electronically filed, printed and mailed, or emailed on your behalf, saving you time and manpower. For additional information on Tabs3 E-file, see KB Article R11788, “All About Tabs3 E-file.”

- If you are using the Create 1099 Disk File utility in Tabs3 Accounts Payable, you must configure a Filing Information Returns Electronically (FIRE) account from the IRS. This provides you with the necessary Payer Name Control and Transmitter Control Code for the process. Be sure that you apply for a transmittal code early. It could take 45 days to receive the code from the IRS. For more information, see https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire.

- If you plan to print the forms using Tabs3 Software, we recommend ordering 1099 forms from Nelco®. These forms are guaranteed 100% compatible with Trust Accounting and Accounts Payable. Nelco has over 50 years of experience in the business forms industry. You can order forms by calling 1-800-266-4669 or via http://www.nelcosolutions.com/Tabs3.

To learn more about the Form 1099-MISC and Form 1099-NEC, see E-file Forms 1099 with IRIS | Internal Revenue Service (irs.gov).

Trust Accounting Q&A: Automate Positive Pay

November 2023 Tags: Positive Pay, Trust Accounting

No comments

We run the Positive Pay export process in Trust on a daily basis. Is there a way to automate this utility?

You can use a startup option with Trust to automatically export Positive Pay. This allows you to create the export using a shortcut. You can use the same shortcut to add this as a scheduled task in Windows.

The startup option is “/POSITIVEPAY #”, where # is the bank account that you want exported.

To add POSITIVEPAY as a startup option

- Make a copy of your Trust desktop icon with a distinctive name (e.g. “Positive Pay Export”).

- Right-click the new desktop icon and select Properties.

- In the Target field, add a space after the path and then enter “/POSITIVEPAY #” (e.g., “C:\Program Files\Tabs3\TAS.EXE” /POSITIVEPAY 1).

- Click OK to update the shortcut.

The export file is overwritten each time the export is run. If you want to retain a copy of the export, copy or move the export file before performing the export again.

Note: Trust will close once the export has been completed.

Feature Article: Check Requests

September 2023 Tags: Accounts Payable, Checks, PracticeMaster, Trust Accounting, Version 2023

No comments

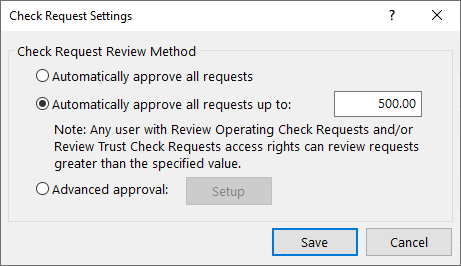

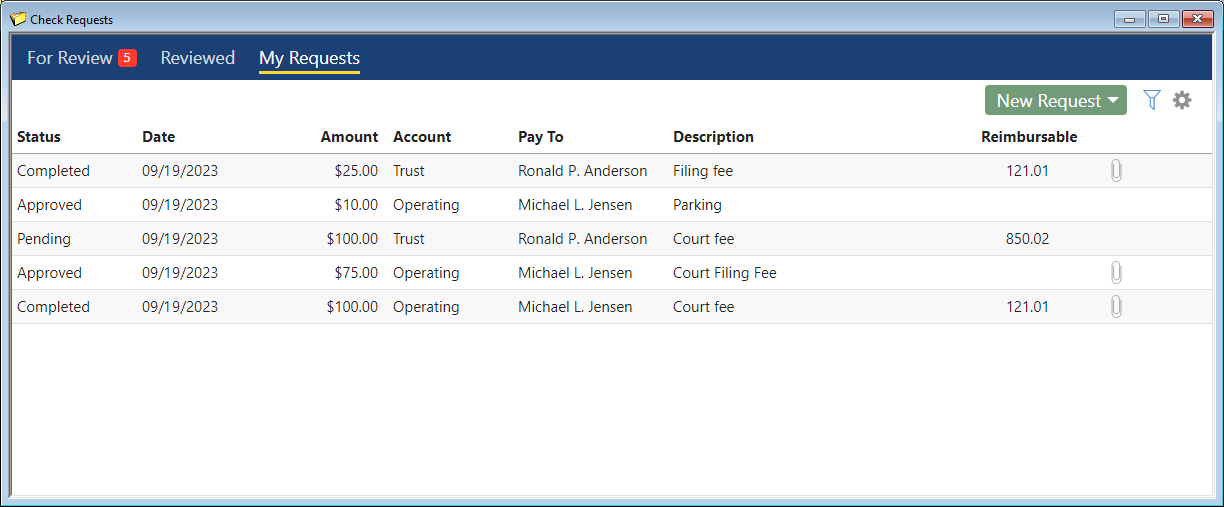

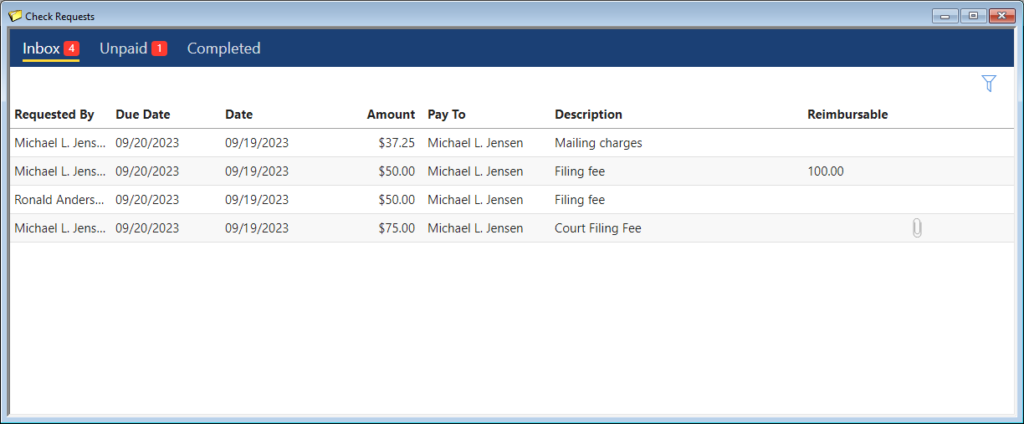

A Check Requests feature is now available in PracticeMaster, which allows users to add a check request for payment on behalf of a client or a work expense. Once the request is approved, users in Tabs3 Accounts Payable or Trust Accounting can create an invoice and generate a check or electronic funds transfer (EFT).

The Check Requests Settings window in PracticeMaster allows you to optionally configure a threshold at which a check request must be reviewed. An advanced option is available to set additional thresholds for which users can review requests, based on the amount. To access the Check Request Settings window, in the PracticeMaster Quick Launch search for and select “Check Request Settings.”

The Check Requests window in PracticeMaster allows users to enter their requests, as well as allows those who can review check requests to approve or deny them. To access the Check Requests window, in the PracticeMaster Quick Launch, search for and select “Check Requests.”

The Check Requests window in Trust and AP shows approved requests and allows users to create Trust Transactions or Invoice/Manual Check entries based on the check request. To access the Check Requests window, in the Trust or AP Quick Launch, search for and select “Check Requests.”

New access rights to Add Operating Check Requests, Add Trust Check Requests, Delete Other Users’ Check Requests, Review Operating Check Requests, Review Trust Check Requests, and Allow Self-Approval of Check Requests have been added. For additional information, see KB Article R11818, “Access Rights.”

This feature is available in Version 2023. For more information about check requests, see KB Article R11923, “Tracking Check Requests.”

KB Corner: Reports Information & Resources

September 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Reports, Resources, Tabs3 Billing, Trust Accounting

No comments

The Tabs3 Software provides a wide range of reports, as well as documentation resources to help you get the most out of reports. Information on reports can be found in many places, so where should you look first?

Knowledge Base Article R11793, “Reports Information & Resources,” provides a list of resources with information regarding reports in the Tabs3 Software, making it easy to find what you are looking for. This article includes links to Knowledge Base Articles, Report Packs, Guides, and Videos. You can find information on comparing report information, report analyzation, specialty reports, and more!

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Trust Accounting Q&A: Combine Trust Transactions

September 2023 Tags: Checks, Reconciliation, Trust Accounting

No comments

Is it possible to combine multiple Trust checks into a single transaction to make the reconciliation process easier?

The Combine Trust Transactions utility is used to combine two or more unpaid check, EFT, or deposit transactions into a single combined transaction that can be cleared on the reconciliation.

To Combine Trust Transactions

- In the Quick Launch, search for and select “Combine Trust Transactions.”

- Select the desired Bank #.

- Select a Type of Checks and enter the Check # that will be used for this transaction.

- Click the Select Transactions button.

- Select the desired transactions by clicking in the (check mark) column.

- Click OK.

- Press Ctrl+S.

Now all of the entries you included on the combined transaction will show as a single item on your reconciliation.

Trust Accounting Q&A: Check Test Pattern

July 2023 Tags: Checks, Printing, Trust Accounting

No comments

We just ordered new Trust checks. Before we start printing checks, is there a way to make sure that everything will line up properly?

In Trust Accounting, a check test pattern can be printed that is comprised of “X’s” where the information would be printed. Although the test pattern can be printed on an actual check form, we recommend using a blank sheet of paper and holding it up to the check form so as not to waste checks.

To print a check test pattern

- In the Quick Launch, search for and select “Print Check Test pattern.”

- In the Selected Printer section, select your check printer.

- In the Output To section, select Printer and click OK.

- Select the Bank and then click OK.

If the information does not line up, adjustments can be made to the margins and printer offset adjustment via Print Setup.

Feature Article: Version 2023 is Here!

June 2023 Tags: Accounts Payable, Checks, Client Portal, Contacts, Outlook Integration, Platinum, PracticeMaster, Tabs3 Billing, Tabs3 CRM, Trust Accounting, Version 2023

No comments

Version 2023 has some great new features to check out!

Tabs3 Platinum Software Highlights

- Client Portal – We’ve added a client portal to Tabs3 Billing that allows selected clients to access their current balance and billing history with any web browser. When combined with Tab3Pay, clients can submit electronic payments that automatically apply towards their current balance due.

- Check Requests – A check request feature has been added to the software allowing you to enter, track, and review requests for reimbursements via PracticeMaster. Those check requests can then be used to create an invoice and generate a check or electronic funds transfer (EFT) in Tabs3 Accounts Payable or Trust Accounting.

- Outlook Recurring Event Synchronization – Enhanced the Microsoft 365 Exchange Connector so recurring events created in Outlook will synchronize with the PracticeMaster calendar.

PracticeMaster Highlights

- Tabs3 CRM – Easily track and manage potential client leads with Tabs3 CRM (client relationship management). Tabs3 CRM is an add-on service that will help your firm build your business with customized intake forms and marketing automation. Once your firm is ready to take on the client, you can easily create a client in PracticeMaster using an import process. Additionally, the PracticeMaster Conflict of Interest Search can optionally check leads in Tabs3 CRM for conflicts.

- Contact Categories – A new access right has been added allowing you to control who can add new Contact Categories. Contact Categories are used in the Contact file to classify contacts by type such as attorney, judge, opposing counsel, etc.

Tabs3 Software Highlights

- Simplified Update – Beginning with Version 2023, any necessary data conversions are done automatically during the installation. This means you don’t need to perform additional steps prior to using the software, greatly simplifying the update process. Furthermore, if you are currently on Version 2020 or later, updating to the latest version can be done with a single installation.

For in-depth information on all of the new Version 2023 features, including screenshots, refer to Knowledge Base Article R11925, “Version 2023 Introduction to New Features.” A list with links to all Version 2023 information can be found in R11927, “Version 2023 Information and Resources.”

To download Version 2023, visit Tabs3.com/update or contact your local consultant.

Spotlight: Dashboards

June 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Dashboards are an easy way to get a quick overview of important data. Dashboards can be accessed via the Dashboard tab of the Home Page and provide the following information:

Tabs3 Billing Dashboard – Displays Accounts Receivable and Work-in-Process for each aging period, as well as a Cash Receipts and a Billing History billing widget to compare figures for the past two years. The dashboard can optionally be filtered in Platinum edition applications for one or more timekeepers, categories, or locations.

PracticeMaster Dashboard – Displays the current month’s Calendar, a list of upcoming events, a My Task list that allows you to easily check off completed items, and a Recap of Hours graph. Additionally, buttons to Add Event, Add Task, and Add Fee are included.

Trust Accounting Dashboard – Displays a summary of your firm’s active Bank Accounts and a list of Recent Trust Transactions. Additionally, buttons to Import Bank Transactions, Print Checks, and Add Transactions are included.

Accounts Payable Dashboard – Displays a list of Unpaid Invoices. Additionally, buttons to quickly Print Checks, Post Checks, print a Check Register, and Add Invoices are included.

General Ledger Dashboard – Displays a summary of your firm’s Bank Accounts and a list of Recent Bank Transactions. Additionally, buttons to Import Bank Transactions and Add Journal Entries are included.

Quick Tip: Print User Initials

June 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Printing, Reports, Tabs3 Billing, Trust Accounting

No comments

Did you know that you can choose whether or not to print the initials of the user who runs a report on the left side of the footer?

To print the user initials in the report footer

- In the Quick Launch, search for and select “Print Setup.”

- Select the desired Printer.

- Click the Advanced Printing Features button.

- In the Footer section, select the Print User Initials check box.

- Click OK.

- Click OK.

Trust Accounting Q&A: Positive Pay Export

May 2023 Tags: Bank Accounts, Trust Accounting

No comments

Our bank has started offering a Positive Pay service and we want to start participating. Does Trust have that capability?

Both Tabs3 Trust Accounting (Trust) and Tabs3 Accounts Payable (AP) include the ability to export a Positive Pay file which can be submitted to your bank.

To configure the Positive Pay export for the first time

- In the Quick Launch, search for and select “Positive Pay Export.” A First Time Configuration wizard will be displayed.

- Select the Bank Account you want to configure and then click Next.

- Specify which additional columns you want to include in the export file. If you are not sure which columns to include, contact your bank to determine their requirements.

- Specify whether to include voided checks in the export file and if so, which character to use as an indicator, then click Next.

- Specify the date range of the checks you want to export and click Next.

- Specify the location to which to save the export file and click Export.

You can now upload the export file to your bank. For future exports, any new checks added since the last export will be included by default.

For more information on using Positive Pay and steps to configure additional banks, see Knowledge Base Article R11833, “Exporting Checks Using Positive Pay.”

Trust Accounting Q&A: Transferring Between Trust Accounts

March 2023 Tags: Trust Accounting

No comments

I need to transfer money from one trust account to another trust account. How do I record the process in Tabs3 Software?

We recommend using positive and negative EFT transactions to transfer the amount from one account to another. A positive EFT will reduce a trust balance, whereas a negative EFT will increase a trust balance.

To transfer funds from one trust account to another

- In the Quick Launch, search for and select “Trust Transaction Entry.”

- Enter an EFT to remove the funds from one trust.

- Select the Trust ID from which you want to remove funds.

- Select a Type of EFT.

- In the Amount field, enter a positive amount.

- Enter any other information as needed.

- Press Ctrl+S.

- Enter an EFT to deposit the funds to another trust.

- Select the Trust ID to which you want to move funds.

- Select a Type of EFT.

- In the Amount field, enter a negative amount.

- Enter any other information as needed.

- Press Ctrl+S.

Feature Article: Timekeepers vs. Users

February 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Timekeepers, Trust Accounting, Users

No comments

The difference between Timekeepers and Users is often confused. So what exactly is the distinction between how timekeepers and users are used in the software?

Users represent anyone who uses the software, or a resource that needs to be scheduled, such as a conference room. Timekeepers represent any person whose time is entered or billed, such as attorneys and paralegals.

You work with timekeepers and users every day, possibly in ways you don’t even realize. Let’s take a look at some different ways timekeepers and users are used in the software below.

Timekeepers can be used to:

- Track time

- Assign billing rates

- Specify which timekeeper is primary, secondary, and originating for a matter

- Track billing and productivity

- Specify reporting ranges

- Specify fee compensation rules (Tabs3 Billing only)

- …and more

Users can be used to:

- Log in to the software

- Specify access rights

- Track who enters data in Tabs3 Billing, PracticeMaster, Trust Accounting (Trust), Accounts Payable (AP), and General Ledger (GL)

- Add to groups to make entering calendar records easier

- …and more

Because there are such different uses for timekeepers and users, when, how, and why you should add or delete them vary. When adding or deleting timekeepers and users, keep the following in mind:

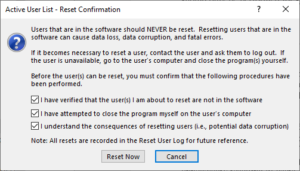

- You can only add as many timekeepers as your license allows. Because of this, it may be necessary to renumber or delete timekeepers or add timekeepers to your license.

- There is no limit to the number of users you can add; you are instead limited by how many users can be logged in to the software at the same time. Because of this, there is never a need to delete users. In fact, deleting users can cause Data File Integrity Check Errors.

It is important to note that Tabs3 Billing and Trust are licensed by Timekeeper whereas PracticeMaster, AP, and GL are licensed by User. For more information on timekeeper and user limits, refer to Knowledge Base Article R10788, “Active User Limits.”

Not sure what your timekeeper or user login limits are? These can be found in the About window (in the Quick Launch, search for and select “About”). The About window displays the Active User Limit in each of the applications. In Tabs3 Billing, you can also see the Maximum Timekeeper Limit, and in Trust you can see the Maximum Attorney Limit. For more information about what is contained in the About window, refer to Knowledge Base Article R11865, “Information in the About Window.”

For more information on deleting timekeepers and users, refer to Knowledge Base Articles R10969, “Renumbering vs. Deleting Inactive Timekeepers,” and R10840, “Deleting User IDs.”

Knowing the difference between timekeepers and users can help you know which settings may need to be changed when necessary, as well as when you should add or delete them, or update your license. For more information on timekeeper and users, refer to the Help by pressing F1 from any window.

KB Corner: Ethical Walls in Tabs3 Software

February 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Resources, Tabs3 Billing, Trust Accounting

No comments

Ethics are an integral part of any business, but in the field of law they are especially important. Tabs3 Software works to ensure that your firm has the tools to maintain ethical walls in order to protect your clients and cases.

Knowledge Base Article R11459, “Ethical Walls in Tabs3 Software,” discusses how to use Tabs3 Software to create ethical walls in your firm. The Tabs3 Software provides Conflict of Interest searching, the option to make clients secure and accessible by only certain users, the ability to control who sees work by assigning timekeepers, and the ability to set up access profiles to control who can access specific functions of the software.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Feature Article: 1099 Changes for Tax Year 2022

January 2023 Tags: 1099s, Accounts Payable, Trust Accounting

No comments

The IRS changed the layout of Form 1099-MISC and Form 1099-NEC for tax year 2022. Tabs3 Trust Accounting (Trust) and Accounts Payable (AP) have been updated to print using the new form layouts. To ensure compatibility, order your forms from Nelco®. These forms are guaranteed to be 100% compatible with Tabs3 Software. You can order forms by calling 1-800-266-4669 or visiting NelcoSolutions.com/Tabs3.

Additionally, the Tabs3 E-file feature has been updated to support the state of Alabama’s requirement for the State income amount to be filled in. See KB Article R11922, “Form 1099-MISC and Form 1099-NEC Changes for Tax Year 2022” for additional information.

Update to Version 22.2.15 or later for changes to 1099s.

Note: Due to the form changes, you will not be able to print 1099 forms for tax year 2021 or prior after updating. The 1099 Report can still be used to gather information for prior year.

KB Corner: All About Verification Lists

January 2023 Tags: Accounts Payable, General Ledger, Resources, Tabs3 Billing, Trust Accounting

No comments

Verification lists are optional and can make it easy to confirm what activities have been done by whom in the software. Many firms review these on a regular basis, verifying which transactions have been added, changed, and deleted by the users in the firm. Verification Lists can be generated for much more than fees; there are more than 15 different verification lists in Tabs3 Billing, Trust Accounting (Trust), Accounts Payable (AP), and General Ledger (GL).

Knowledge Base Article R10793, “All About Verification Lists,” provides detailed information about the various verification lists available in the software including a breakdown of verification lists, how to enable or disable optional verification lists, which verification lists are temporary, how to delete verification lists, a complete list of all verification lists, and much more.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Video of the Month: Filing 1099s Quickly and Easily using Tabs3 E-file

January 2023 Tags: 1099s, Accounts Payable, Resources, Trust Accounting

No comments

With tax season just around the corner, Tabs3 E-file is here to help simplify your 1099 submission process! Tabs3 has partnered with Nelco to provide Tabs3 E-file, a complete solution to filing your Form 1099-MISC, Form 1099-NEC, and Form 1096. Learn how to easily upload your data to the Tabs3 E-file portal so that your 1099’s can be electronically filed, printed and mailed, or emailed on your behalf.

Watch this three-minute video here:

Training Videos can be accessed at Tabs3.com/videos. You can also access the videos in the Quick Launch by searching for and selecting “Training Videos.”

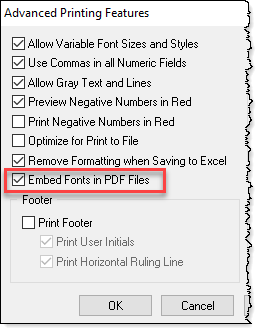

Quick Tip: Save Your Reports as PDFs

January 2023 Tags: Accounts Payable, General Ledger, PracticeMaster, Reports, Tabs3 Billing, Trust Accounting

No comments

Did you know that you can save reports generated from Tabs3 Software as PDFs? Instead of maintaining folders and/or boxes of paper, store your reports digitally instead!

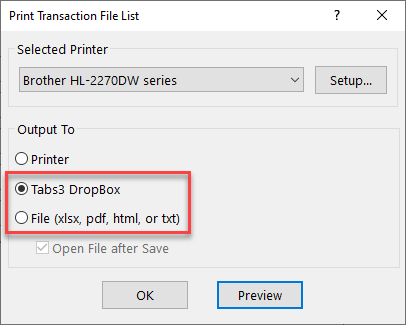

When printing your reports, there are two ways to save the file as a PDF:

- Select an Output of Tabs3 DropBox. Tabs3 Software’s DropBox is a good option if you want to review the PDF report(s) before saving them to their final location. You can then save multiple files in the DropBox to another location simultaneously. Once all your reports are saved to the DropBox, simply drag them to the desired location.

- Select an Output of File, and then save the file as a PDF to the desired location. This is a good option if you’re ready to save the report and be done.

Once you start saving your reports as PDFs, think about saving them as document management records in PracticeMaster. When saved to PracticeMaster, your reports become easily searchable. Worried about security? Assigning documents to a secure client will limit the information available to users. When running a conflict search, any hits belonging to a secure client will display “This is a secure record.”

Tip: Use the Send to PracticeMaster option while in File Explorer to automatically create document management records in PracticeMaster for multiple reports. For more information on the Send to PracticeMaster feature, see Knowledge Base Article R11571, “Document Management Frequently Asked Questions.”

Trust Accounting Q&A: Changing the Trust Terminology on Statements

January 2023 Tags: Statements, Tabs3 Billing, Trust Accounting

No comments

How can I change the terminology used in the trust section of my statements?

The terminology for trust information on statements is stored in Tabs3 Trust Accounting, and is specific to each bank you have configured.

To change the trust account terminology

- In the Quick Launch, search for and select “Bank Account.”

- Select the bank you want to modify in the Bank Account field.

- Click the Integration Settings button.

- In the Tabs3 Billing Statement/WIP Terminology section, enter the text you want to use in each field.

- Click on the OK button.

- Press Ctrl+S.

Feature Article: Scheduled Payments

December 2022 Tags: Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

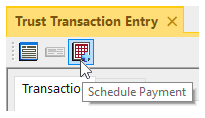

You can now schedule a future-dated payment or series of payments from within Tabs3 Billing and a future-dated trust deposit or series of trust deposits from within Trust Accounting that will automatically process via Tabs3Pay. This allows you to get paid on a specific date, even when you’re not in the office. Additionally, recurring payments are a convenient way of providing a simple payment plan for your clients. Once the payment is processed, it will be displayed in the Tabs3 Billing Import Online Payments window for import.

In Tabs3 Billing, the Schedule Payments window can be accessed via the Quick Clicks pane in Matter Manager or Statement Manager, a toolbar button in Payment Entry, or in the Quick Launch pane by searching for and selecting “Schedule Payment.”

In Trust, the Schedule Payments window can be accessed via a toolbar button in Trust Transaction Entry,  or in the Quick Launch pane by searching for and selecting “Schedule Payment.”

or in the Quick Launch pane by searching for and selecting “Schedule Payment.”

Note: Managing scheduled payments is performed in the Tabs3Pay Web Portal.

Trust Accounting Q&A: Reporting Payments to the Firm

November 2022 Tags: Reports, Trust Accounting, Year-End

No comments

We need a list of all payments to our firm from trust accounts in the last year. Which report should I run for this?

The Check Register by Payee can be used to print a list of checks written to any payee for any date range.

To print a Check Register by Payee for firm payments

- In the Quick Launch, search for and select “Check Register by Payee.”

- On the Transactions tab, enter the desired Date range.

- On the Options tab, select a Payee range of “FIRM” Thru “FIRM”.

- Select any additional criteria.

- Click OK.

Feature Article: Startup Options

October 2022 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

Did you know that you can have certain software features automatically run as soon as a Tabs3 Software application is opened? You can use startup options to help automate tasks by entering command line options in the Target field of the desktop shortcut icon.

For example, in Tabs3 Billing you can have the Fee Entry window automatically open, and in PracticeMaster you can have the Matter Manager window automatically open. Other popular startup options include opening the Calendar and the Timer window. Some startup options, such as the Data File Integrity Check, can be automatically started in every application. You can even use a startup option to automatically enter your User ID. If you do not use a password, the Logon window will be bypassed and you will automatically be logged into the software. However, if a password has been set up for the user, the User ID will be filled in and a password will be required.

To add a startup option to PracticeMaster

- Right-click the desktop icon used to start PracticeMaster and select Properties.

- From the Properties window, click the Shortcut tab. The startup option can be entered following the program file name in the Target field. An example of the Target field when using the User ID startup option is:”C:\Program Files\Tabs3\CM.EXE” ALICEAn example of the Target field when using the option to start the Data File Integrity Check at a specified time is:”C:\Program Files\Tabs3\CM.EXE” /DFIC /T 11:30p

Multiple startup options can be specified in the Target field if desired. Options must be separated by a space. An example of multiple startup options is:

“C:\Program Files\Tabs3\CM.EXE” /TIMER /CALENDAR /WEEKLY

- Click OK.

You can find a complete list of startup options applicable to the application you are working in by searching for “Help Topics” in the Quick Launch. On the Index tab, simply type “Startup Options”. For more information on automating tasks, including startup options, refer to Knowledge Base Article R11034, “Automating Tabs3 Software Maintenance Tasks.”

Spotlight: Real Estate Firm Future-Proofs Billing & Payment with Tabs3Pay

September 2022 Tags: Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

With a 72-year record of providing smart, creative, and effective legal guidance to their Washington community, the time was right for the firm’s billing and payment processing solution to evolve once more.

Hanson Baker wanted to create an effortless billing experience for clients by emailing invoices to clients and accepting online credit card payments. Finding a processor with transparent rates that integrated easily with their current software and workflows proved challenging, so the firm turned to Tabs3 Software.

As long-time Tabs3 Software users, they enjoyed Tabs3’s excellent software support and the many features available to them through PracticeMaster, such as the matter manager and dashboard. With affordable fees, transparent pricing, and the ability to attach payment links directly to their emailed invoices, Tabs3Pay was a natural choice.

To help with implementation, Hanson Baker worked with software consultant Christina Cline of C.R. Cline and Company. As a certified Tabs3 consultant, Cline was able to guide Hanson Baker through the implementation process and address potential hang-ups. With her oversight, adopting Tabs3Pay went off without a hitch.

Now, Hanson Baker’s clients enjoy a modernized, reliable payment process – and the firm saves time with smoother invoicing workflows. Not only has Hanson Baker seen improved cash flow due to shorter payment processing times with Tabs3Pay, but the need for collections has also declined.

Hanson Baker appreciates Tabs3Pay’s straightforward pricing and low processing fees, as well as usability features like the ability to print receipts after the fact. They’ve also benefited from Tabs3Pay’s integration with Tabs3 Software, reducing errors from manual input and wasted time from double data entry.

Cline reports that Tabs3 Software’s long record of excellent service is another reason Tabs3Pay was the right choice for Hanson Baker. “Tabs3 has been around for a long time,” Cline says, “Their support is in Lincoln, NE. You’re going to have your problem resolved. When you purchase Tabs3 and get it up and running, you’re not left to flounder.”

If you’re a current Tabs3 Software user and want to improve your firm’s billing and payment workflows, Tabs3Pay could be the solution. Tabs3Pay is designed to offer streamlined, trust accounting-compliant payment processing for law firms while integrating seamlessly with other Tabs3 Software applications. For more information, call (402) 419-2200, email sales@tabs3.com, or visit Tabs3.com.

Trust Accounting Q&A: Renaming Payees

September 2022 Tags: Contacts, Payees, Trust Accounting, Version 2022

No comments

When adding a payee, we misspelled the name. How can we change the payee’s name?

Beginning with Version 2022, Trust payees are now contacts. Therefore, in order to rename a payee, you must rename its associated contact using the Rename Contacts utility.

To rename a payee in Trust

- From the Quick Launch, search for and select “Rename Contact.”

- In the Old Contact ID field, select the contact associated with the payee you want to rename.

- In the New Contact ID field, enter the new name you want to use for that payee.

- If you want to update the individual name fields of the contact, select the Update Name fields check box and fill in the New Value fields for each name field. (Note: If you want to update the Full Name field based on these changes, select the Update Full Name based on First, Middle, and Last Name fields check box.)

- If you want to review the contact after changing it, select the Open the contact record after renaming the contact to update additional fields check box.

- Click OK.

KB Corner: Requesting and Importing Tabs3Pay Online Payments and Trust Deposits

August 2022 Tags: Email Statements, Resources, Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

Tabs3 Billing includes the ability to insert a personalized link or button to Tabs3Pay in your email templates used for emailing statements and sending trust deposit requests. These links can then be used by your clients to pay their bills or make trust deposits directly via credit/debit card or electronic check. Those payments and trust deposits can then be imported into Tabs3 Billing using the Import Online Payments program.

Knowledge Base Article R11905, “Requesting and Importing Tabs3Pay Online Payments and Trust Deposits,” guides you through the steps necessary to include payment links in your Email Statements and import any payments you receive.

Our Knowledge Base can be accessed at support.Tabs3.com. You can also access our Knowledge Base in the Quick Launch by searching for and selecting “Knowledge Base.”

Feature Article: Request Trust Deposit

July 2022 Tags: Clients, Email Statements, Tabs3 Billing, Tabs3Pay, Trust Accounting

No comments

When it is time for a client to replenish a trust account, use the new Request Trust Deposit feature! Enter the amount requested and select the corresponding IOLTA account. Tabs3 Billing then creates an email message with an embedded payment button. Review the message and send it to your client.

Your client receives the message, clicks the Make Trust Payment button, and funds the trust account by ACH bank transfer or credit/debit card.

Request Trust Deposit is powered by Tabs3Pay, the secure online payments platform built into Tabs3 Billing and Trust Accounting.

Note: The Trust Request feature requires Tabs3 Billing and Trust Accounting Version 2022 (Build 22.2.3) and later. Including a Make a Trust Payment button in a trust request requires a Tabs3Pay merchant account configured in Tabs3 Billing and Trust Accounting. For additional information, see KB Articles R11869, “Configuring Tabs3Pay,” and R11905, “Requesting and Importing Tabs3Pay Online Payments and Trust Deposits.”

Spotlight: Backup Strategies

July 2022 Tags: Accounts Payable, General Ledger, PracticeMaster, Tabs3 Billing, Trust Accounting

No comments

When was the last time you backed up your Tabs3 Software data and tested the viability of your backup? If your firm was required to restore from a backup right now, how much data would be lost?

Regular backups are critical to the safety of your data. Tabs3 Software automatically prompts you to run a backup when a function cannot be easily reversed or when interruption of a process can cause errors in the data. When prompted to make a backup, review the date and time of the last backup shown on the prompt, and ask yourself how much data will need to be reentered if a restore is required. If you are not comfortable with the amount of work required after restoring, then you should back up your data before going any further. If you regularly find yourself skipping backups because it’s difficult to get every user to exit the software, consider the Platinum edition of Tabs3 Software. The HotBackup feature allows you to make backups while other users are still working in the software and Tabs3 Platinum Software can automatically recover from interruptions to many functions, including Update Statements.

Tabs3 Software provides the ability to back up and restore data from within the software. If you are using the non-Platinum edition of the software, you can keep up to three internal backups with a size limit of 2GB each. If you are using the Platinum edition of the software, backups are practically unlimited! You can keep up to 198 user-defined HotBackups, each limited in size only by the available hard drive space.